Once upon a sunny earnings day, Nvidia dropped a sparkling $57 billion quarter (up 62% year over year!), with data centers alone hauling in $51.2 billion. Jensen Huang grinned wide, saying, “No bubble here, just an AI rocket taking off!” Blackwell chips are flying off shelves, cloud GPUs are sold out, and he calls data centers “intelligence factories” just getting warmed up. Next quarter? They’re aiming for $65 billion. Investors cheered, shares jumped 5%, and everyone left feeling like the AI party is only beginning.

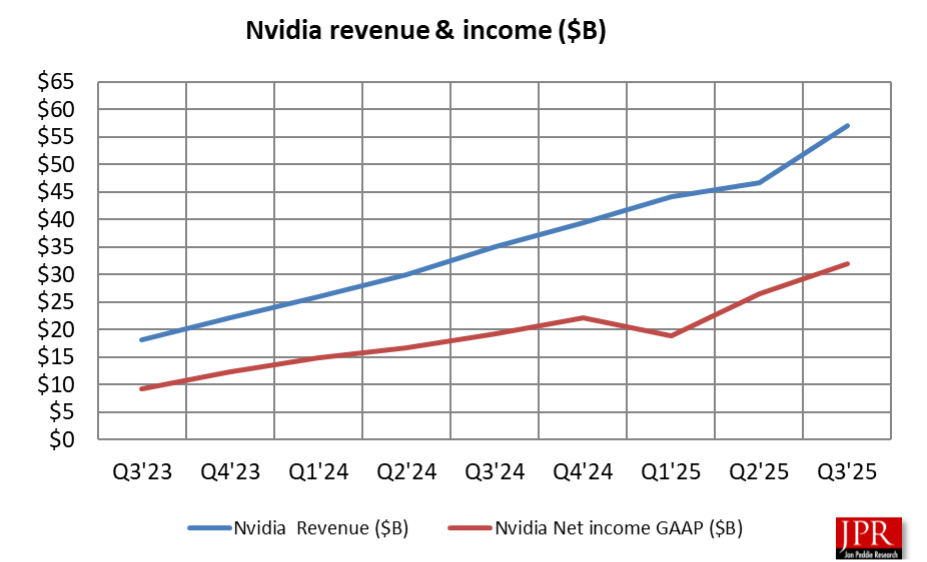

Nvidia reported revenue of $57.0 billion for the third quarter ended October 26, 2025, an increase of 22% from the previous quarter and 62% from the same period a year ago. The company’s gross margins for the quarter were 73.4% on a GAAP basis and 73.6% on a non-GAAP basis. GAAP and non-GAAP earnings per diluted share were both $1.30 for the quarter.

“Blackwell sales are off the charts, and cloud GPUs are sold out,” said Jensen Huang, founder and CEO of Nvidia. “Compute demand keeps accelerating and compounding across training and inference—each growing exponentially. We’ve entered the virtuous cycle of AI. The AI ecosystem is scaling fast—with more new foundation model makers, more AI start-ups, across more industries, and in more countries. AI is going everywhere, doing everything, all at once.”

Nvidia has returned $37.0 billion to shareholders through share repurchases and cash dividends during the first nine months of fiscal 2026, with $62.2 billion remaining under its share repurchase authorization as of the end of the third quarter.

Figure 1. Nvidia’s sales and profits over time. (Source: Nvidia/JPR)

“There’s been a lot of talk about an AI bubble,” Huang said. “From our vantage point, we see something very different.”

Huang is actually smiling about the whole “AI bubble” talk. He says there’s no bubble, just a massive wave of real demand rolling in.

The numbers back him up: Nvidia just posted a record $57 billion in revenue, with data centers alone pulling in $51.2 billion (that’s 66% growth year over year!). Huang explains it’s because a bunch of big tech shifts (accelerated computing, generative AI, etc.) are all hitting at the same time.

He even has this cool way of describing AI data centers: “They’re intelligence factories, and we’re only in the early innings.”

Next quarter? They’re guiding to around $65 billion. No wonder the stock popped 5% after the call; investors are feeling pretty cheerful right now.

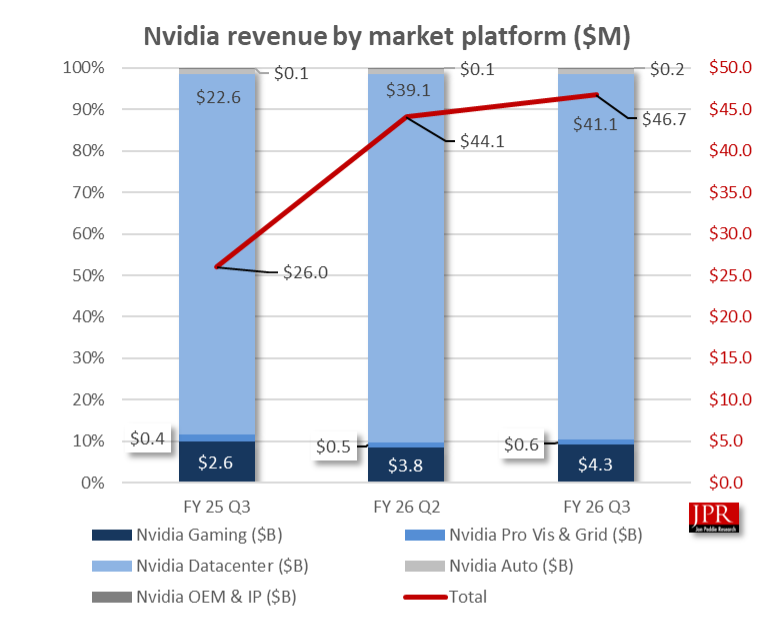

Figure 2. Once again, the Data Center sales are overwhelming all other segments of Nvidia’s business. (Source: Nvidia/JPR)

Data Center revenue for the third quarter reached $51.2 billion, an increase of 66% from a year ago and 25% from the previous quarter, driven by accelerated computing, AI models, and agentic applications. Blackwell Ultra is the leading architecture across customer categories, with prior Blackwell architecture seeing continued demand. H20 sales were minimal in the third quarter.

Data Center compute revenue was $43.0 billion, up 56% from a year ago and 27% from the previous quarter. Networking revenue was $8.2 billion, an increase of 162% from a year ago, driven by NVLink compute fabric for GB200 and GB300 systems, and 13% from the previous quarter, driven by XDR InfiniBand products and Ethernet for AI solutions.

Professional Visualization revenue was up 56% from a year ago and 26% from the previous quarter, driven by the launch of DGX Spark and growth of Blackwell sales. Automotive revenue was up 32% from a year ago and 1% from the previous quarter, driven by adoption of self-driving platforms.

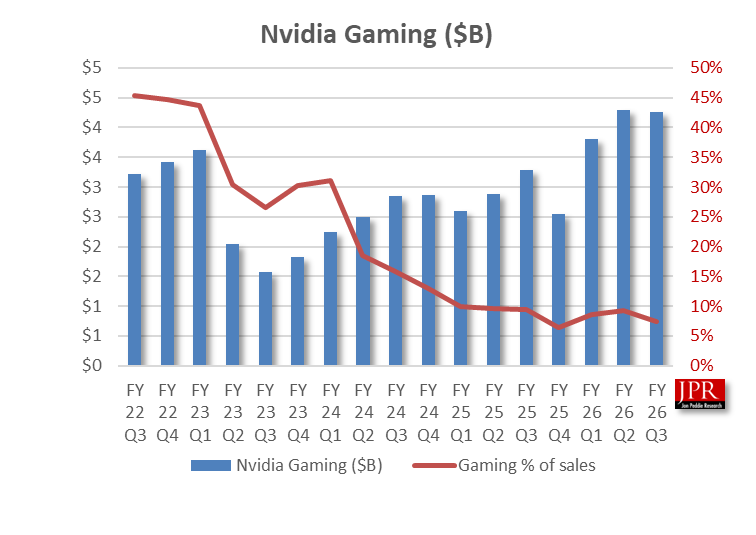

Nvidia had a strong third quarter in gaming. (Source: Nvidia/JPR)

Gaming revenue was up 30% from a year ago, driven by demand for Blackwell, and down 1% from the previous quarter as channel inventories normalized.

Nvidia crushed Wall Street expectations in its third quarter, delivering a 62% revenue jump and stronger-than-forecast growth for the current quarter, while executives brushed off AI bubble worries and doubled down, predicting trillions of dollars in industry-wide AI infrastructure spending by the end of the decade. And, Nvidia’s forecast is also upbeat, as the company is predicting a 15% gain in Q4’25 over this quarter.

Following Nvidia and its competitors? You’d be surprised at how many want to replace Nvidia, how they plan to do it, their SWOT, and their financing. If that sounds intriguing, you should get a copy of our new AI Processors Market Development Report.

LIKE IT? THINK YOUR FRIENDS AND ASSOCIATES MIGHT? PLEASE SEND IT TO THEM WITH OUR BEST WISHES.