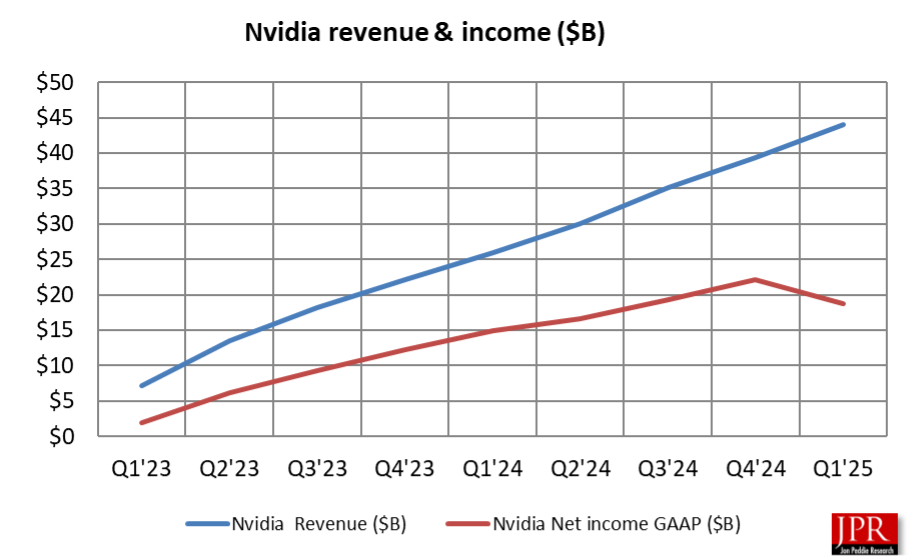

Nvidia reported strong Q1 2025 revenue of $44.1 billion, a 12% quarterly and 69% yearly increase. CEO Jensen Huang highlighted robust global demand for their AI infrastructure, driven by Blackwell architecture and a tenfold surge in AI inference token generation. Data Center revenue led at $39.1 billion, up 73% annually, fueled by AI applications. Gaming revenue also saw record growth. However, new US export rules for H20 products in China resulted in a $4.5 billion charge and lost revenue. Overall gross and diluted earnings per share showed positive figures, even after accounting for the H20 impact.

Nvidia reported revenue for the first quarter ended April 27, 2025, of $44.1 billion. This represents an increase of 12% compared to the prior quarter and a rise of 69% from the corresponding period last year.

“Our Blackwell NVL72 AI supercomputer—a ‘thinking machine’ designed for reasoning—is now in full-scale production across system makers and cloud service providers,” stated Jensen Huang, founder and CEO of Nvidia. “Worldwide demand for Nvidia’s AI infrastructure is notably strong. AI inference token generation has increased tenfold in one year, and as AI agents gain wider adoption, the need for AI computing will grow. Nations globally are identifying AI as vital infrastructure—similar to electricity and the Internet—and Nvidia occupies a central position in this significant transformation.”

On April 9, 2025, the US government informed Nvidia that a license is necessary for exports of its H20 products into the China market. Consequently, Nvidia recorded a $4.5 billion charge in the first quarter of fiscal 2026 related to excess H20 inventory and purchase commitments due to reduced demand for H20. Sales of H20 products reached $4.6 billion for the first quarter of fiscal 2026 before the new export licensing regulations. Nvidia was unable to ship an additional $2.5 billion of H20 revenue during this quarter.

For the quarter, GAAP gross margin was 60.5%, and non-GAAP gross margin was 61.0%. If the $4.5 billion charge were excluded, the first quarter non-GAAP gross margin would have been 71.3%.

For the quarter, GAAP earnings per diluted share were $0.76, and non-GAAP earnings per diluted share were $0.81. Excluding the $4.5 billion charge and its associated tax impact, the first-quarter non-GAAP diluted earnings per share would have been $0.96.

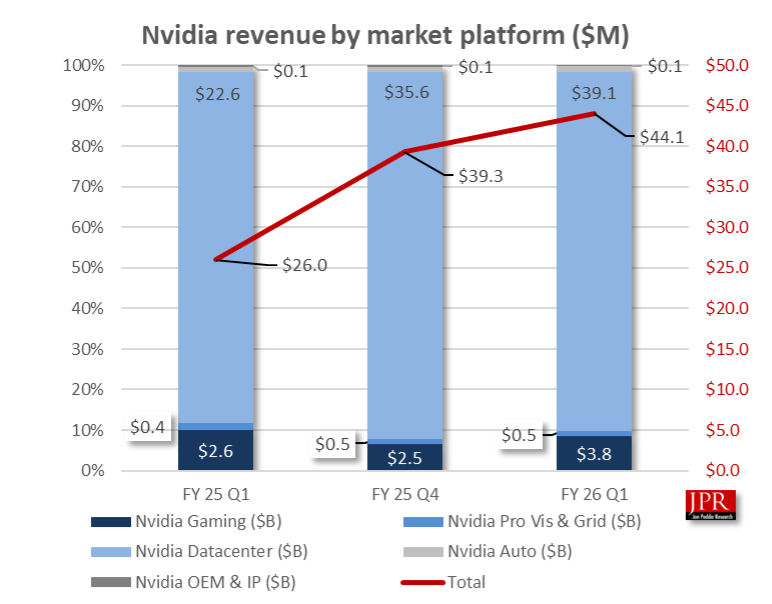

Data Center revenue for the first quarter reached $39.1 billion, a rise of 73% compared to the previous year and an increase of 10% from the prior quarter. This notable yearly and quarterly growth resulted from demand for Nvidia’s accelerated computing platform, utilized for large language models, recommendation engines, and generative and agentic AI applications. The expansion of its Blackwell architecture reached all customer segments, with large cloud service providers continuing as the company’s primary customers, accounting for slightly less than 50% of Data Center revenue. Data Center compute revenue totaled $34.2 billion, a gain of 76% from the prior year and a 5% increase sequentially. Networking revenue amounted to $5.0 billion, a 56% increase year over year and a 64% rise sequentially, propelled by the growth of NVLink compute fabric in Nvidia’s GB200 systems and ongoing adoption of Ethernet for AI solutions at cloud service providers and consumer Internet companies.

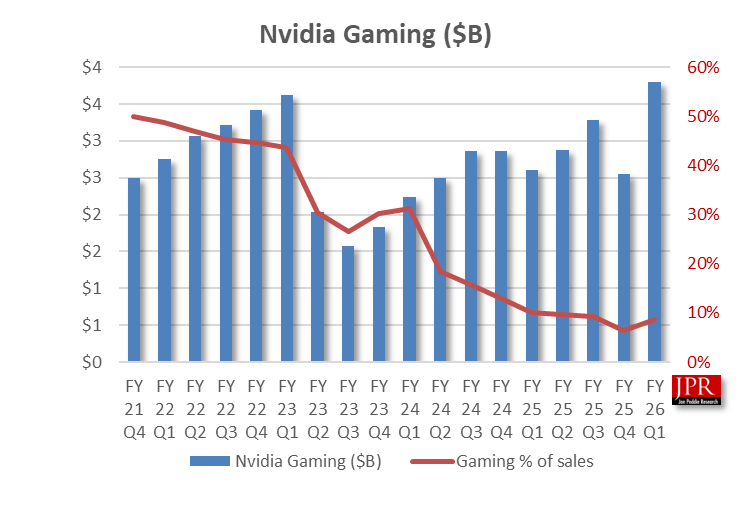

Gaming revenue for the first quarter achieved a high point, increasing by 42% from the previous year and by 48% from the prior quarter, driven by sales of the Blackwell architecture, representing a rapid adoption phase in company history, Nvidia reported.

Professional Visualization revenue for the first quarter showed a 19% increase compared to the previous year and remained consistent with the prior quarter. The yearly growth was supported by wider adoption of Ada RTX workstation GPUs, addressing workflows in AI acceleration, real-time graphics rendering, and data simulation.

Automotive revenue for the first quarter increased by 72% from the previous year and decreased by -1% from the prior quarter. The yearly increase was driven by sales of the company’s self-driving platforms.

Outlook

Nvidia’s outlook for the second quarter of fiscal-year 2026 includes an anticipated revenue of $45.0 billion, with a possible variance of 2%. This projection considers a decrease in H20 revenue of about -$8.0 billion due to recent limitations on exports.

The projected GAAP gross margin is 71.8%, and the non-GAAP gross margin is expected to be 72.0%, with a possible fluctuation of 50 basis points. The company continues its efforts to reach gross margins in the mid-70% range later in the fiscal year.

GAAP operating expenses are anticipated to be approximately $5.7 billion, and non-GAAP operating expenses are expected to be around $4.0 billion. The projected growth in operating expenses for the full fiscal-year 2026 is in the mid-30% range.

LIKE WHAT YOU’RE READING? INTRODUCE US TO YOUR FRIENDS AND COLLEAGUES.