Positron, a 3-year-old AI cloud inference processor developer in Lovelock, Nevada, just raised $230 million in Series B funding, valuing the company at over $1 billion. The company is tackling energy and memory constraints in large-scale AI inference with its Atlas FPGA system and upcoming Asimov ASIC platform. With a focus on power efficiency and high memory bandwidth, Positron’s tech is perfect for customers like Jump Trading, which saw 3× lower latency versus GPU-based systems. Expect more deployments and product releases as Positron expands.

Three-year-old Lovelock, Nevada-based AI cloud inference processor developer, Positron, has raised $230 million in an oversubscribed Series B round at a post-money valuation above $1 billion. The funding supports a transition from Positron’s first-generation FPGA system, Atlas, to its custom ASIC platform, Asimov. The company plans to continue operating with an FPGA-first, ASIC-second cadence and maintain an annual product release cycle to extend market reach beyond early adopters.

Positron says its architecture targets two constraints that are becoming central in large-scale inference: energy availability and memory capacity.

Atlas is designed as a transformer-specific inference system built using Intel’s Agilex 7 M-series FPGAs, with HBM and DDR5. The design focuses on high memory‑bandwidth utilization—reported at around 93% of theoretical HBM bandwidth in internal characterizations—rather than peak floating‑point throughput. In memory-bound transformer workloads, this approach allows token generation rates that can exceed those of contemporary GPU-based systems despite lower nominal FLOPS.

Atlas systems are manufactured in the US and deployed in air-cooled data centers. Typical Atlas AIBs consume on the order of 150–200 W and are designed to fit within common power envelopes of roughly 7–15 kW per rack. Positron positions this as attractive to customers with strict power and cooling limits, as well as to those concerned about supply chain resilience and domestic manufacturing.

The Asimov platform extends the Atlas architecture into a multi-die ASIC. Asimov replaces HBM with LPDDR5X, accessed via a chiplet-based memory architecture. Each Asimov device is planned to support approximately 2 TB of LPDDR5X memory, with four devices per Titan server, for about 8 TB of memory per system. At the device level, Positron has indicated a target of more than 2,304 GB of RAM per accelerator, significantly above announced GPU configurations in the same time frame. The compute elements of Atlas incorporate Arm cores and expanded networking to support larger, tightly coupled inference clusters.

To enable the LPDDR-based architecture, Positron has a joint development agreement with Credo Semiconductor for the Weaver memory fan-out gearbox chiplet. Weaver uses 112 Gb very‑short‑reach SerDes on one side and LPDDR PHY on the other, providing high bandwidth per millimeter of die edge at low energy per bit. Asimov is expected to incorporate 20 Weaver chiplets, allowing high aggregate bandwidth without HBM. Because the design is chiplet-based, Positron anticipates a minor update cycle when LPDDR6 versions of Weaver become available, without a full ASIC re-spin.

At the system level, the Titan platform will host four Asimov accelerators in an air-cooled server configuration. Positron’s roadmap calls for tape‑out of Asimov toward the end of 2026, with initial samples expected near the end of the first quarter of 2027. The company intends to maintain a pattern where each major architecture first appears in FPGA form for early deployment and feedback, followed by an ASIC version, enabling faster iteration and validation with real workloads.

Jump Trading illustrates Positron’s target customer profile and engagement model. Jump initially deployed Atlas as a customer to evaluate the system against GPU-based configurations for latency-sensitive inference in financial trading. On those workloads, Jump observed roughly threefold lower end-to-end latency relative to a comparable system based on Nvidia’s H100 GPU, in an air-cooled form factor compatible with existing data-center constraints. Following these evaluations, Jump joined the Series B as a co-lead investor and is collaborating with Positron on future hardware.

For trading firms and similar users, Positron is emphasizing both latency and power efficiency. These organizations often operate deployments spanning co-location facilities at exchanges and their own data centers, with tight power budgets and significant annual compute spending. Atlas’ power envelope and transformer-specific software stack were designed so that customers could test workloads remotely within a day and bring up on-premises deployments in weeks instead of months. Positron is considering exposing lower levels of its software stack beyond early partners so that customers can better align algorithm design with the hardware roadmap.

From a market-level perspective, Positron’s approach assumes that inference performance will increasingly be constrained by power and memory, not peak compute throughput. The Atlas and Asimov platforms are structured around a memory-first design, high effective bandwidth, and large memory capacity per accelerator, with an emphasis on running large-context or memory-intensive models such as multitrillion-parameter language models, video workloads, and trading systems. The use of LPDDR and air cooling is intended to avoid reliance on CoWoS packaging and HBM supply, which remain bottlenecks for many GPU vendors.

Operationally, Positron has grown to about 50 employees in recent months and plans to reach around 100 by the end of 2026. The company performs its ASIC design work internally to maintain control over late-stage design iterations and mask decisions, drawing on a team with experience in both FPGAs and ASICs. It plans to continue offering FPGA-based versions of future architectures alongside ASICs so that customers can adopt new features early and provide feedback that informs subsequent tape-outs.

Revenue expectations for 2026 are strong, and the company projects broad commercial traction roughly two and a half years after launch. Current customers include cloud infrastructure providers, advanced computing organizations, and latency-sensitive verticals such as trading. As AI inference demand grows and constraints around energy, memory capacity, and supply chains become more pronounced, Positron is positioning its hardware and funding base to compete with general-purpose GPU offerings on those axes rather than on raw theoretical compute alone.

The financing was co-led by Arena Private Wealth, Jump Trading, and Unless, with participation from Qatar Investment Authority, Arm, and climate-oriented fund Helena, and was announced at Web Summit Qatar. The company has spent about $38 million to date and reports purchase orders exceeding that amount, positioning the new capital to fund both product development and scaled deployment.

Figure 1. Thomas Sohmers (left), CTO and cofounder, and Mitesh Agrawal (right), CEO of Positron AI. (Source: Kavita Agrawal)

“We’re grateful for this investor enthusiasm, which itself is a reflection of what the market is demanding,” said Mitesh Agrawal, CEO of Positron AI. “Energy availability has emerged as a key bottleneck for AI deployment. And our next-generation chip will deliver 5× more tokens per watt in our core workloads versus Nvidia’s upcoming Rubin GPU. Memory is the other giant bottleneck in inference, and our next generation Asimov custom silicon will ship with over 2,304 GB of RAM per device next year, versus just 384 GB for Rubin. This will be a critical differentiator in workloads including video, trading, multitrillion-parameter models, and anything requiring an enormous context window. We also expect to beat Rubin in performance per dollar for specific memory-intensive workloads.”

What do we think?

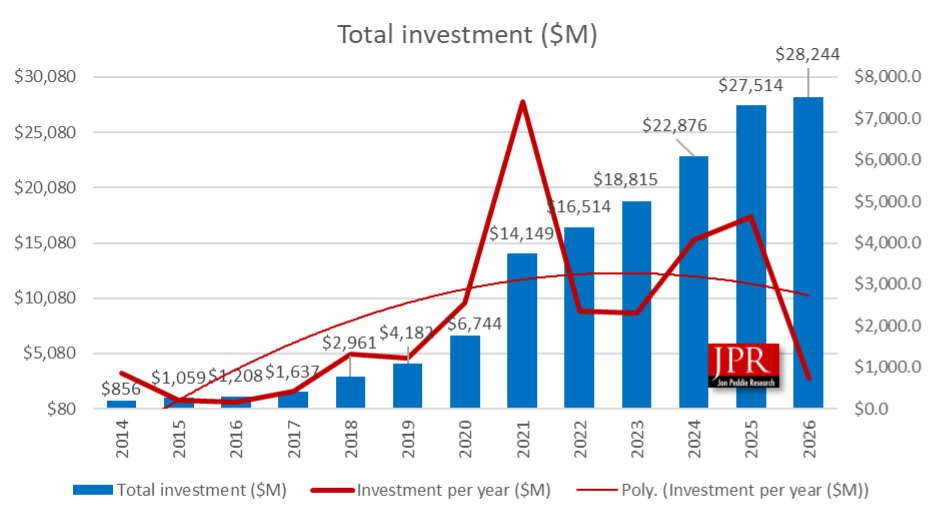

Positron has done what too many other AI processor companies haven’t—demonstrated its capabilities. As grandma used to say, the proof of the pudding is in the eating. The 101 AIP start-up companies have gathered over $28.2 billion in investment, with six of them in the billionaire’s circle.

Figure 2. Investment in AIP start-ups.

Twenty-seven percent of the AIP start-ups are in the >$300 million segment, and now Positron has joined that club.

Our 2026 AI Processor Market report covers all 143 suppliers, their SWOTs, products, management team, and the market sizing and forecast. You can get a free summary of it here, and if you’re really interested in this market, we’ll send you a sample copy.

LIKE WHAT YOU SAW HERE? SHARE THE EXPERIENCE, TELL YOUR FRIENDS.