In our 2026 AI Processors Market report, we identified billion-dollar AI processor start-ups and a second tier raising $500 million to $999 million. Etched just joined that tier with a $500 million round led by Stripes and Peter Thiel, bringing total funding to $620 million and a $5 billion valuation. The company builds Sohu, a transformer-only ASIC supported by TSMC and engineers from Broadcom and Cypress. Etched argues silicon, not software, limits AI scale. Potential buyers include AWS, Meta, xAI, Microsoft, Oracle, or OpenAI.

The Etched crew celebrates their valuation. (Source: Etched)

In our 2026 AI Processors Market report, we list the billionaire’s club of AIP start-ups that have raised a billion dollars or more in private and corporate investment, prior to acquisition or IPO. The second tier are the companies that have received $500 million to $999 million in investments.

This week, Etched (founded in Cupertino, California, in 2022 by Gavin Uberti, Chris Zhu, and Robert Wachen) joined the second tier with a $500 million investment led by Stripes and Peter Thiel, valuing the company at a staggering $5 billion. That brings their total reported investment to $620 million.

There are 102 private start-ups in the AIP markets, many of them hoping to unseat, or at least get a share of, Nvidia’s market share in APIs.

Of the 133 start-ups, 21 have been acquired or shut down, and eight others have filed for an IPO.

All told, over $28 billion has been invested in privately held AIP companies.

Etched positions Sohu, its custom transformer-only NPU/ASIC, as the core of a specialized AI hardware strategy. The company partners with TSMC and recruits senior engineers from Broadcom and Cypress to build a hyper-efficient transformer engine. Etched argues that AI workloads now demand specialization rather than general-purpose architectures, and the market trend supports that shift. The team identifies infrastructure as the true limiter of AI scale, asserting that silicon capacity—not software—sets the ceiling for future model growth.

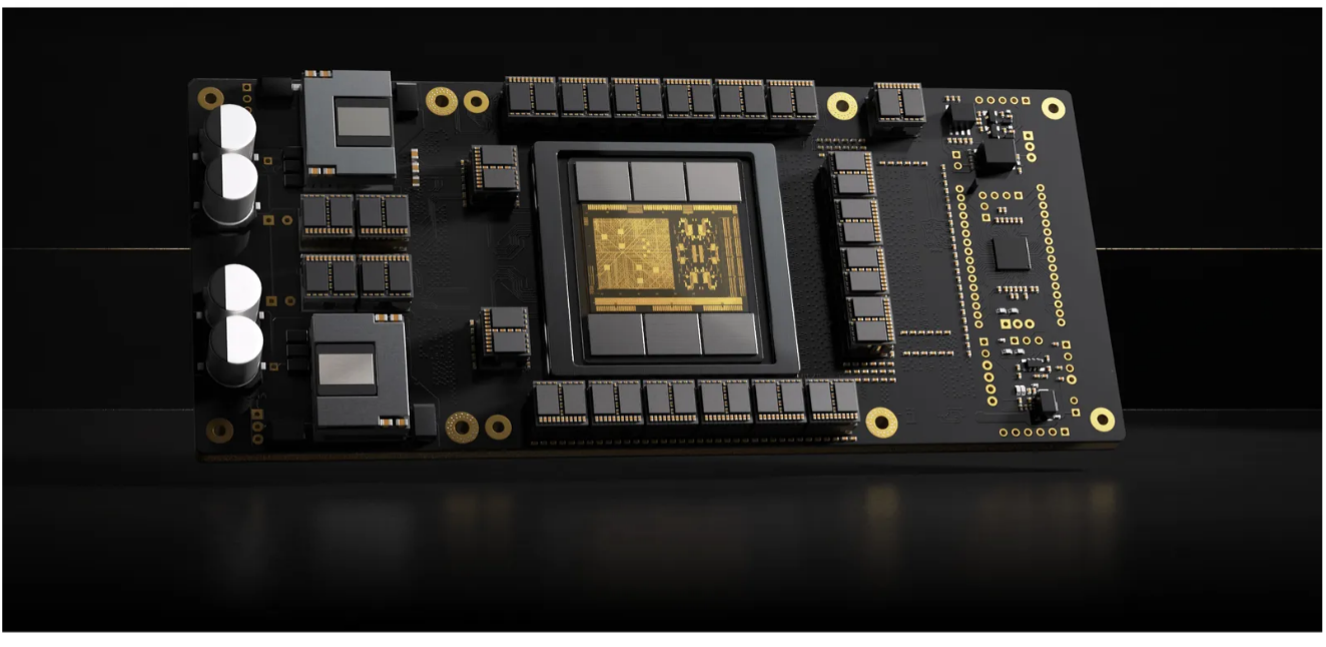

Figure 1. Artist’s rendition of Etched Sohu chip. (Source: Etched)

Prior to the asset buy by Nvidia, Groq had raised $210 million and sold for $20 billion—100:1 valuation and sale, so the $5 billion valuation on Etched seems conservative in comparison.

But who would acquire them? AWS might, to use their chip for inferencing. Meta and Grok could use a highly efficient inference chip. And even Microsoft might make a bid, and that’s just the big guys. Oracle could be a bidder, and maybe OpenAI. Clearly, there will be a lot of the heavyweights sniffing around now that Thiel has put money into them. Thiel may not be the most popular or liked person in the world, but he has demonstrated he knows how to identify opportunities.

Truly, $500 million is a lot of money, and Etched could use it to build out its stack, moving it from just a chip company to a total solutions company. Etched’s Sohu processor uses High Bandwidth Memory (HBM3E), putting it in competition with Nvidia for memory manufacturers’ production. Rubin uses HBM4 and will take all that Micron, Samsung, and HK can give it, and its demand and volume make it tough for Etched to get enough supply. Tenstorrent, a member of the billionaire’s club, made it their policy not to get in Nvidia’s crosshairs. Etched needs to be careful not to stir up the bear.

LIKE WHAT YOU’RE READING? INTRODUCE US TO YOUR FRIENDS AND COLLEAGUES.