$3,000

Add-in Board report – a report on the Graphic Add-in Board market

The Add-in Board report is a quarterly report that focuses on the market activity of PC graphics controllers for mobile and desktop computing. The report provides an in-depth look at the PC graphics market and includes unit shipment and segment market share data, and trend analysis.

For an annual subscription that includes four quarterly reports click here.

Category: Reports

Description

The AIB Report Contains

- Worldwide AIB Shipment forecast by segment, 2015 to 2025.

- Attach rate of AIBs from 2001.

- Detailed worldwide AIB Shipment Volume, by segment, and forecast to 2025.

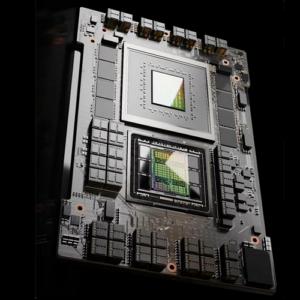

- Major suppliers: Detailed market share data-on the shipments of AMD, Nvidia, and others.

- Market share history from Q1 2004.

- Percentage of shipments by region, from 2015 to 2024.

- Market value of AIBs, and pricing trends

- A Vision of the future: Building upon a solid foundation of facts, data, and sober analysis, this section pulls together all of the report’s findings and paints a vivid picture of where the PC graphics market is headed.

- Memory load and forecast.

This is, in general, a supply-side report. Data for the unit shipments come from the

suppliers of the graphics processor semiconductors. We constantly survey the AIB

suppliers as well as the OEM and ODM suppliers in the course of our business.

Q4’23 Add-in board Table of Contents

- Attention first-time readers

- Overview

-

- Definitions

- Methodology

- Primary research for this report

- Secondary research for this report

- About Jon Peddie Research

-

- Executive Summary

- What is in this report

- Introduction

- The quarter in general

- Q4’24

- Good enough isn’t

- Quarter-to-quarter changes

- Attach rate

- Market shares

- Segments

- AIB price bands

- Q4’24

- Market Value

- Geographical distribution

- Forecast

- Market value

- Market value and forecast by segment

- Market value and forecast by region

- Memory size

- Geographical distribution

- AIB developments in the quarter

- AMD revenue soars on Data Center strength

- Intel has a good Q4 but weak Q1 guidance

- Nvidia once again tops projections for Q4 ’24

- Summary of AIBs for 2023

- High-end graphics card prices back on the rise

- Moore Threads commits to AI GPUs and training center

- Nvidia 24GB RTX 4090D Dragon for China

- Nvidia and AMD in near lockstep with Ada, RDNA 3 GPU-generation rollouts

- AMD Radeon Pro W7700 workstation board

- Bolt Graphics’ ray tracing

- Surprise! Steam says more gamers use Nvidia than AMD

- Graphics card prices have remained stable in 2023, so far

- New Intel AIBs

- Has Intel abandoned its GPU effort?

- What is happening in China?

- Appendix

- GPUs, AIBs, and PCs

- Categorizations

- FLOPS vs. FRAPS: Cars & GPUs

- Why good enough isn’t

- Production schedule and pipeline

- Sales channel

- Multi-AIBs

- GPU compute

- Graphics boards

- AIB suppliers

- Glossary

- Index