$3,500

Workstation report series – Professional Computing Markets and Technologies

Q1’24 market results fall in line with expectations

By Senior Analyst and JPR Workstation Report author, Alex Herrera

The first quarter of 2024 saw workstation shipments rise 4.6% year-over-year and decline 9.0% sequentially. Both figures are in line with expectations, according to JPR Workstation Report author and senior analyst Alex Herrera.

“The quarter’s performance reflected a sensible, organic growth rate that was expected to gradually resume following the up-and-down tumult of the pandemic, with the 4.6% YoY falling neatly within the market’s historic “steady state” growth,” Herrera explained. “Similarly, the 9% sequential decline falls within the typical range of Q1’s historical cyclical dip.”

Providing the most comprehensive look at the workstation market available, the JPR Workstation Report delves into breadth and depth across all slices of the workstation and professional GPU markets, including:

- Complete breakdown of traditional workstation market by units, revenue, platforms, key components, verticals, geography, and vendors

- Workstation market forecast

- Complete breakdown of workstation GPU market by units and revenue, across product classes (including integrated graphics) and vendors

For an annual subscription that includes four quarterly reports with two semi-annual editions click here.

Contact us now if you would like to receive a sample of the report.

Description

Providing the most comprehensive look at the workstation market available, the JPR Workstation report series delves into breadth and depth across all slices of the workstation and professional GPU markets, including:

- A complete breakdown of the traditional workstation market by units, revenue, platforms, key components, verticals, geography, and vendors

- Workstation market forecast

- A complete breakdown of the workstation GPU market by units and revenue, across product classes (including integrated graphics) and vendors

JPR’s market sizing and segmentation is based primarily on bottom-up analysis from data collected from the major professional graphics IHVs and workstation OEMs profiled in this report.

Table of Contents

- Tables

- Figures

- Navigating this report

- Methodology

- Some – but not all – white-box coverage

- Market highlights

- Q4’23

- Calendar 2023

- Q4’23 meets expectations with anticipated modest rebound of 6.3% year-over-year

- The shifting market mix: fixed versus mobile workstations

- The recent pandemic-fueled surge in mobiles and corresponding dip in fixed machines

- The pandemic-shifted mobile majority: transient or permanent?

- Despite substantial declines since Q4’21 peak, the mobile workstation still shipping in excess of its pre-pandemic pace 7

- The historical trend suggests more “catch-up” fixed sales to come … unless there’s a new normal?

- Lots of post-pandemic forces still in play, keeping the market in flux 9

- A closer look behind the mobile’s bullish run and the tepid bounce-back of fixed machines

- Workstation volume by model type and class

- The pre-2023 fixed model class segmentation

- The Super Single Socket (SSS) era of high-core count multi-chiplet 1S processors trigger a shift in fixed market segments

- 2023 and beyond: evolving the fixed workstation market segments

- Fixed workstation market segment metrics in Q4’23 20

- The transition — in part or in full — of traditional 2S workstations to Ultimate (1S) models

- Ultimate (2S) market share logically continuing to slide

- The pre-2023 fixed model class segmentation

- Sub-entry fixed models are plumbing the low end and blurring lines … but adoption has been limited

- Mobile workstation market segmentation

- Workstation component and configuration metrics

- Workstation OSes: Windows (Pro and Pro for Workstations) vs. Linux

- Base workstation platforms / CPUs

- AMD is back in the workstation CPU game with Ryzen Pro and Threadripper Pro

- Things have changed, as AMD now offers a broad range of workstation-caliber CPUs

- With the full DHL trio on board with Premium models built on Threadripper PRO, AMD’s market share on a growth path

- Ryzen Pro making Tier 1 progress as well, in both fixed and mobile segments

- Intel still the dominant CPU supplier, but AMD applying pressure across the board

- Xeon had taken majority share from Core in fixed workstations, but the script has flipped dramatically … and Intel is (at least for now) OK with that

- Sapphire Rapids arrived to reinforce the Premium class and drive the Ultimate class 39 2S (dual socket) CPU market share essentially all Xeon Scalabel

- (Virtually) all Core everywhere in mobile workstations

- GPU attach rates: professional discrete vs. consumer discrete vs. integrated

- ECC memory attach

- What truly qualifies as a workstation, anyway?

- A litmus test for the modern workstation

- The Creator PC: pushing the bounds of a branded workstation

- Desktop Creator PCs versus fixed workstations: the gray area of Entry and Sub-Entry models

- Fixed Sub-Entry segment — and its contribution to the Creator PC share — remains limited

- Notebook Creator PCs vs. mobile workstations

- An alternate workstation market split: adjusting for Creator PC systems

- Desktop Creator PCs versus fixed workstations: the gray area of Entry and Sub-Entry models

- Vendor market share

- Differences in vendor shares by platform fading

- Apple’s Mac Pro and MacBook Pro

- Datacenter workstations

- Workstation revenue and ASPs

- Mobile vs. fixed revenue

- Fixed unit and revenue distribution by price tiers

- Mobile unit and revenue distribution by price tiers

- Workstation shipments by vertical

- Shipments by geography (Tier 1 only)

- Overarching trends in geographic distribution

- Mobile vs. fixed distribution by global geo

- Dell global leadership is due — virtually solely — to its US dominance

- Dell and HP neck-and-neck in EMEA

- Lenovo slips in APexJ as of late, with sales picked up by HP and Dell

- Shrinking Japan market also an HP-Dell dead-heat

- Sames story in ROW with another virtual tie for Dell and HP

- EMEA distribution by sub-region

- Mobile vs. fixed: EMEA sub-region breakdown

- Workstation vendor shares per EMEA sub-region (Tier 1 only)

- APexJ distribution by sub-region (Tier 1)

- APexJ anchor China slowing its growth, with volume contracting in 2023

- Lenovo the undisputed leader in China, quite sensibly so, while HP making strides

- Dell and HP both gaining in India at Lenovo’s expense

- Rest of ApexJ vendor distribution

- Mobile vs. fixed: APexJ sub-region breakdown

- Full-year calendar 2023 results for workstations

- Outlook on the workstation market

- Market prospects in a vacuum: why workstations — in some form — should remain a healthy market for as far as we can see

- Has the pandemic permanently increased the number of mobile-exclusive workstation users?

- Are mobile workstations as desktop replacements a market boon or not?

- Some market drags to consider

- The bottom line forecast

- Has the pandemic permanently increased the number of mobile-exclusive workstation users?

- Market prospects in a vacuum: why workstations — in some form — should remain a healthy market for as far as we can see

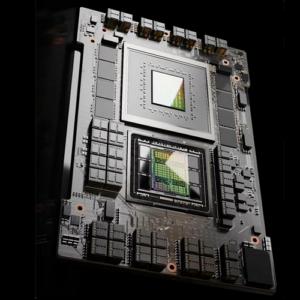

- Professional discrete GPU shipments bottom in Q4’22, bounce in H1’23 and stabilize in H2’23

-

- H2’23 GPU mix shifts back to fixed/add-in

- Intel in the game with Arc Pro … volume a trickle so far

- Professional discrete add-in GPU units and revenue, by price tier

- Effective Q4’23: expanding visibility into the fixed, add-in GPU volume per price band

- Viewing the price bands: bucketing individual SKUs versus the continuum of price vs. volume

- The Mainstream segment now outsells Entry in unit volume … for good reason

- Professional discrete GPU vendor shares per segment: virtually all Nvidia everywhere

- Full-year calendar 2023 results for discrete workstation GPUs

-