AI investment is booming, with $13.5 billion poured into 96 start-ups and an estimated $60 billion in R&D from 24 public companies like Nvidia, AMD, Huawei, and Qualcomm. The frenzy recalls the dot-com bubble, where Amazon, Yahoo, and eBay inspired many imitators that collapsed. Today, Nvidia plays the Amazon-like role, drawing global rivals, while China builds its own ecosystem under US restrictions. Yet no company can dominate every niche. Start-ups may succeed if focused, but most will fail or be acquired. When elephants fight, the ants suffer.

To say AI has captured the imagination of the industrialized world would be an understatement at best; it has completely ignited it and opened its pocketbook.

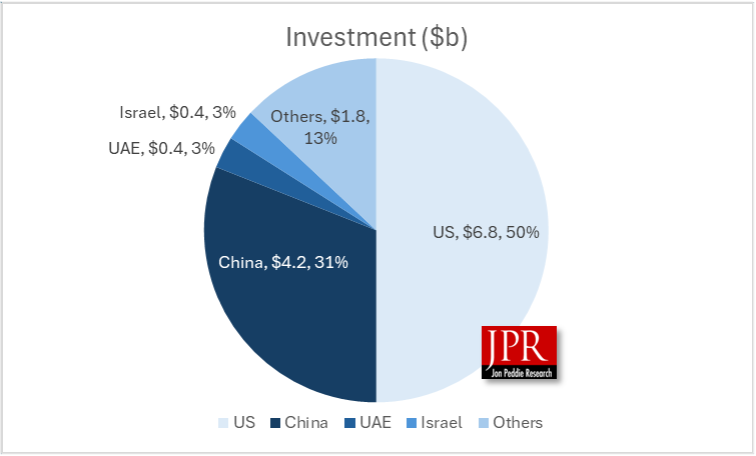

But technological development is fed by investment, and as of today, only two countries are making big commitments in AI processors—China and the US.

And big those investments are. In just the start-up companies, $13.5 billion has been invested in the last few years, with most of it, perhaps not surprisingly, coming from the US.

Investment in AI processor start-ups.

Furthermore, enormous sums have been invested in R&D by the 24 publicly traded AI processor companies such as AMD, Huawei, Nvidia, Qualcomm, and Samsung. These publicly held companies are diverse and have multiple products and projects. If we estimate that just 25% of their combined R&D budgets for 2024 are allocated to AI, that would amount to $60 billion.

The concern on Wall Street and elsewhere is that we are in an AI bubble, similar to the turn-of-the-century dot-com bubble. Is this the hardware equivalent of the dot-com bust? It certainly has some of the aspects of it.

Amazon’s rapid rise in the late 1990s as an online bookstore (then branching into everything) led to hundreds of copycats—Pets.com, Drugstore.com, eToys, Webvan, and more—most of which collapsed when funding dried up. Amazon survived and became the template for e-commerce.

Yahoo! (portals/search): Yahoo was seen as the model of an Internet “portal”—a gateway to news, search, mail, and services. Many tried to become the “next Yahoo,” including Lycos, Excite, AltaVista, and Go.com. But Yahoo itself faltered, and Google’s cleaner search model eventually won.

eBay (online auctions/marketplaces): eBay’s success in peer-to-peer auctions inspired waves of competitors (Onsale, Bid.com, uBid). None achieved the same staying power.

In today’s AI processor market, Nvidia acts as the magnet attracting competitors from all over the world that believe they can outperform Nvidia. In China, the situation is different because the country is being blocked from US technology and must develop its own, which it is doing and will continue to do until achieving parity or dominance.

But Nvidia is more than just an AI processor company; it is a full-stack hardware and software AI supercomputer company, and no AI processor start-up or existing public company is going to overtake Nvidia.

However, no single company like Nvidia, AMD, or Huawei can cover all niches or satisfy every demand for AI acceleration. Therefore, if start-ups remain flexible and carefully select their market segments, they can succeed and help grow the overall market. But the odds are against them, and with 121 companies pursuing the same general goal, most will likely fail. Failure could mean a complete shutdown or a more favorable outcome of acquisition—though probably at a low valuation.

So the market dynamics became a race to find and fill the needs for AI processors, and the titanic battle of the US government versus the Chinese government. The old saying is that when elephants fight, the ants suffer.

We monitor the AI processor market and produce a quarterly report and a comprehensive database about it. You can find more information about it here.

WHAT DO YOU THINK? LIKE THIS STORY? TELL YOUR FRIENDS, TELL US.