AMD closed 2025 on a high note, posting record $34.6 billion in revenue with a 50 % gross margin. The company booked $3.7 billion of operating income and $4.3 billion of net income on a GAAP basis, while non‑GAAP operating income reached $7.8 billion and net income of $6.8 billion. Data Center sales surged 32 % YoY to $16.6 billion, powered by Epyc CPUs and Instinct GPUs. The Client and Gaming segment grew 51 % YoY to $14.6 billion, led by Ryzen CPUs and Radeon GPUs. Looking ahead, AMD expects Q1 2026 revenue around $9.8 billion (±$300 million) with a non‑GAAP gross margin of roughly 55 %.

(Source: AMD)

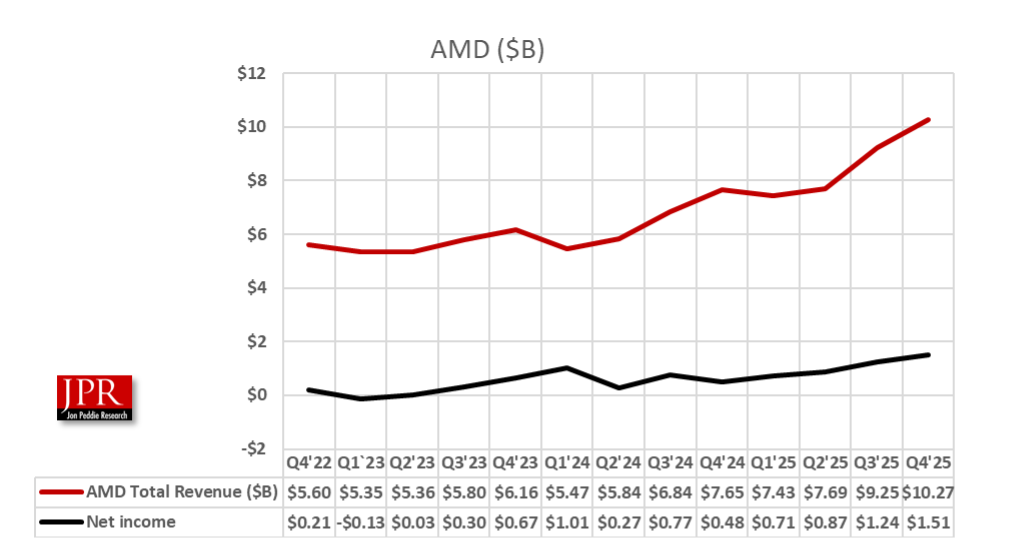

For the full-year 2025, AMD reported record revenue of $34.6 billion, gross margin of 50%, operating income of $3.7 billion, net income of $4.3 billion, operating income of $7.8 billion, and net income of $6.8 billion.

Figure 1. AMD revenue and net income over time. (Source: AMD and JPR)

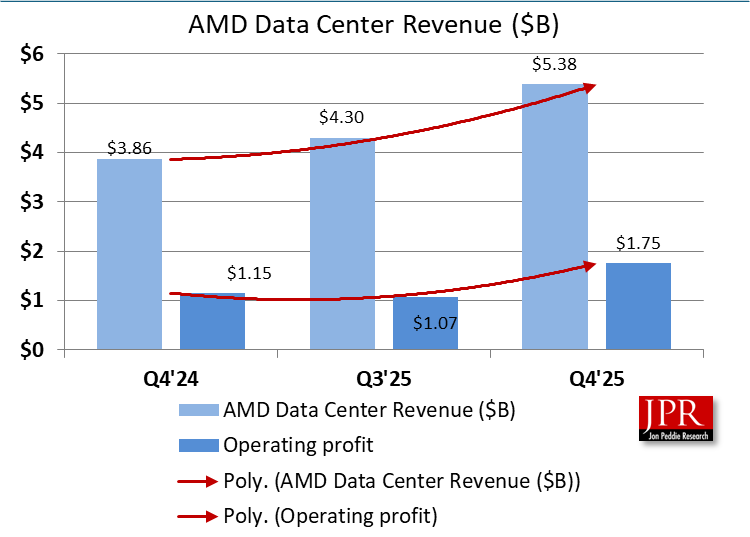

Data Center segment revenue in the quarter was a record $5.4 billion, up 39% year over year, driven by strong demand for AMD Epyc processors and the continued ramp of AMD Instinct GPU shipments.

For the full-year 2025, Data Center segment revenue was a record $16.6 billion, up 32% year over year, reflecting growth across both Epyc CPUs and AMD Instinct GPUs.

Figure 2. AMD’s Data Center results—sequential and year over year. (Source: AMD and JPR)

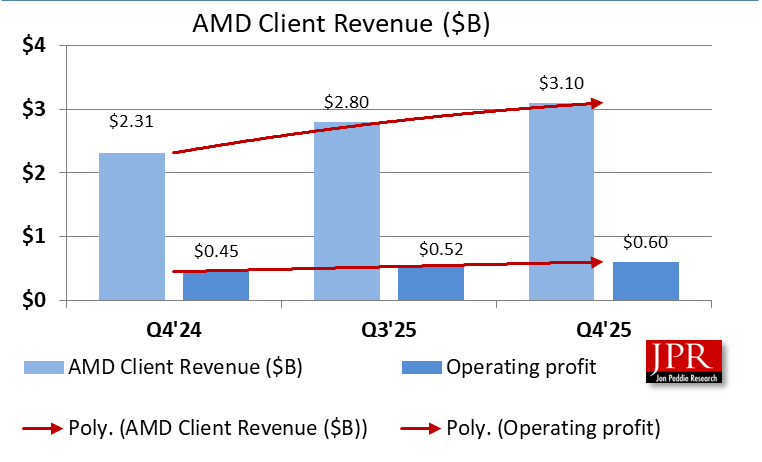

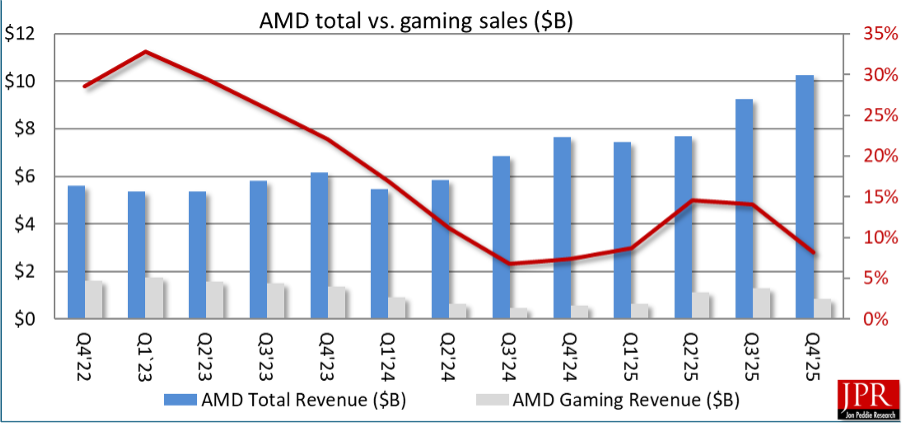

Client and Gaming segment revenue in the quarter was $3.9 billion, up 37% year over year. Client business revenue in the quarter was a record $3.1 billion, up 34% year over year, driven primarily by strong demand for leadership AMD Ryzen processors and continued market share gains. Gaming business revenue in the quarter was $843 million, up 50% year over year, primarily driven by higher semi-custom revenue and strong demand for AMD Radeon GPUs.

For the full-year 2025, Client and Gaming segment revenue was a record $14.6 billion, up 51% year over year. Client business revenue was a record $10.6 billion, up 51% year over year, driven by continued revenue share gains and a richer product mix. Gaming business revenue was $3.9 billion, up 51% year over year, driven by improved semi-custom sales and strong demand for AMD Radeon GPUs.

Figure 3. AMD’s new consolidated client results—sequential and year over year. (Source: AMD and JPR)

“2025 was a defining year for AMD, with record revenue and earnings driven by strong execution and broad-based demand for our high-performance and AI platforms,” said Lisa Su, AMD chair and CEO. “We are entering 2026 with strong momentum across our business, led by accelerating adoption of our high-performance Epyc and Ryzen CPUs, and the rapid scaling of our data-center AI franchise.”

“Our record fourth-quarter and full-year results demonstrate AMD’s ability to deliver profitable growth at scale,” said Jean Hu, AMD executive vice president, CFO, and treasurer. “We achieved record non-GAAP operating income and free cash flow, while increasing our strategic investments to support long-term growth across our high-performance and adaptive computing product portfolio.”

AMD delivered new capabilities for the most demanding PC and gaming workloads with the new Ryzen 7 9850X3D, the fastest gaming processor, powered by the Zen 5 architecture and AMD 3D V-Cache technology.

Figure 4. Total sales versus gaming sales over time. (Source: AMD and JPR)

AMD FSR Redstone is a suite of new machine-learning-based features delivering more immersive visuals for AMD Radeon graphics cards, including AMD FSR Upscaling, Frame Generation, Ray Regeneration, and Radiance Caching enhancements.

Current outlook

For the first quarter of 2026, AMD expects revenue to be approximately $9.8 billion, plus or minus $300 million, including approximately $100 million of AMD Instinct MI308 sales to China. The midpoint of the revenue range represents year-over-year growth of approximately 32% and a sequential decline of approximately 5%. Non-GAAP gross margin is expected to be approximately 55%.

What do we think?

AMD is overdue for a new gaming GPU release, and there have been many leaks and teasers about it. However, with memory prices rising due to the AI land grab, the new gaming AIB may not be snatched up because of the price.

AND IF YOU LIKED WHAT YOU READ HERE, DON’T BE STINGY, SHARE IT WITH YOUR FRIENDS.