Ceva had plenty of news at CES 2025 including an ADAS chipset with Oritek, new partnerships and an expanded collaboration with Edge Impulse, and multi-channel spatial audio with MediaTek.

Ceva Inc. is a publicly traded semiconductor intellectual property (IP) company, headquartered in Rockville, Maryland, and specializing in digital signal processor (DSP) technology. The company’s main development facility is located in Herzliya, Israel, and Sophia Antipolis, France. JPR’s David Harold met with Ceva’s VP of marketing, Moshe Sheier, to find out what is driving their strategy.

One piece of news we found particularly interesting and followed up on after the interview is that Ceva is working with Nvidia’s TAO toolkit to support computer vision applications for the Ceva-NeuPro-Nano NPU IP. This includes full integration of Edge Impulse Studio and support for Nvidia TAO toolkit with Ceva-NeuPro Studio for both the NPN32 and NPN64 Ceva NPUs. Zach Shelby, co-founder and CEO at Edge Impulse, said, “Bringing Nvidia Tao’s computer vision models to the Ceva portfolio will unlock numerous novel use cases for AIoT products that require visual data generation and analysis across industries.”

So, let’s talk about the broader industry trends—hardening IP versus staying with soft IP. How do you see this? Is hardening a sensible route? The chiplet play feels unfinished to me—there are issues with I/O, power, and standards.

Sheier: Let me address both hardening and chiplets. We only do hardening where required, such as in analog or RF. For example, we just announced our new multi-protocol wireless connectivity platform IP, which includes our own RF for the first time: a 12nm TSMC radio for Bluetooth. This is challenging, but we’re investing in radio.

For everything else, we focus on fully synthesizable IP. We’re not providing design services or hardening beyond what’s necessary for RF. Regarding chiplets, we’re not developing them in-house. Instead, we’re partnering with companies like Arm, which have a program where we provide 5G baseband solutions, and they handle upper-layer processing.

That makes sense. How do you feel about the AI market’s direction? Some companies seem focused on consumer devices, while others are targeting enterprise and industrial applications. It’s not clear where the growth is strongest.

Sheier: For Ceva, everything is about edge AI. We define the ‘smart edge’ as anything outside the cloud—whether it’s a base station, satellite, wearable, or industrial device. AI for us means two things: powerful NPUs and efficient AI.

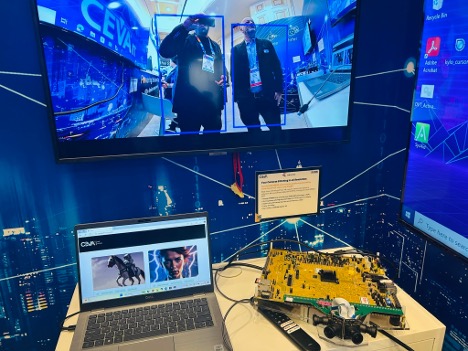

By ‘powerful,’ I mean NPUs delivering tens to hundreds of TOPS. For IoT, whereby devices typically need less than 1 TOP, we offer the NeuPro-Nano. Our NPU families are branded as the NeuPro family, with two main architectures: NeuPro-Nano and NeuPro-M. Here at CES, we’re showcasing NeuPro-Nano, which runs small AI models efficiently.

Can you give us an example?

Sheier: Sure. One demo here uses NeuPro-Nano to power a camera that detects faces and closes automatically when the camera is off. It’s designed for low-power AI models. At the other end of the spectrum, our more powerful NPUs are used in surveillance and automotive applications, offering up to hundreds of TOPS.

How much software support do you provide for these NPUs? Do customers bring their own machine learning models, or do you offer prebuilt models?

Sheier: Great question. We address this in two ways. First, we partner with companies like Edge Impulse, which is a de facto standard for small AI frameworks. They handle training and deployment for small AI models on platforms like NeuPro-Nano. Developers can sample data, train a network, and deploy it on supported hardware seamlessly.

Second, we provide some reference models, like low-power vision (e.g., face detection) and speech recognition (e.g., wake words). These models are meant for reference; we don’t expect customers to use them in production. NeuPro-Nano typically requires just a few megabytes of memory, so it’s optimized for small, efficient AI tasks.

What about industrial IoT and consumer IoT? How does NeuPro-Nano fit into those spaces?

Sheier: NeuPro-Nano targets both. It’s ideal for low-power applications like voice recognition or anomaly detection in industrial machines. Predictive maintenance is another key use case. The architecture is designed to be parallel, efficient, and self-sufficient. Unlike many AI accelerators that require a host CPU, NeuPro-Nano operates independently, with built-in memory management, sparsity, and compression algorithms.

So it’s more than just a typical accelerator?

Sheier: Exactly. It’s a stand-alone processor that includes DSP functionality for preprocessing tasks like filtering and FFTs. This differentiates it from competitors that sell AI accelerators which rely on separate CPUs for memory management. Our approach simplifies the design and makes it more efficient.

What’s the business traction like? Is the company growing?

Sheier: Yes, we’re growing. Ceva has around 500 employees and is publicly traded on NASDAQ. We’ve been in business for 22 years. Two years ago, Amir Panush became our CEO and we refocused on a pure IP model. In 2023, we transitioned back to IP, and 2024 was a growth year. We’re now doing about $105 million in annual revenue, and the company is profitable.

That’s impressive. What’s next for Ceva?

Sheier: We’re excited about 2025. We see strong growth in edge AI, particularly for consumer electronics, automotive, and industrial IoT. At CES, we announced new partnerships for NeuPro-Nano, including Edge Impulse and Cyberon, as well as expanded support for Nvidia’s TAO toolkit. These partnerships strengthen our ecosystem and make it easier for customers to develop and deploy AI models on our platforms.

LIKE WHAT YOU’RE READING? INTRODUCE US TO YOUR FRIENDS AND COLLEAGUES.