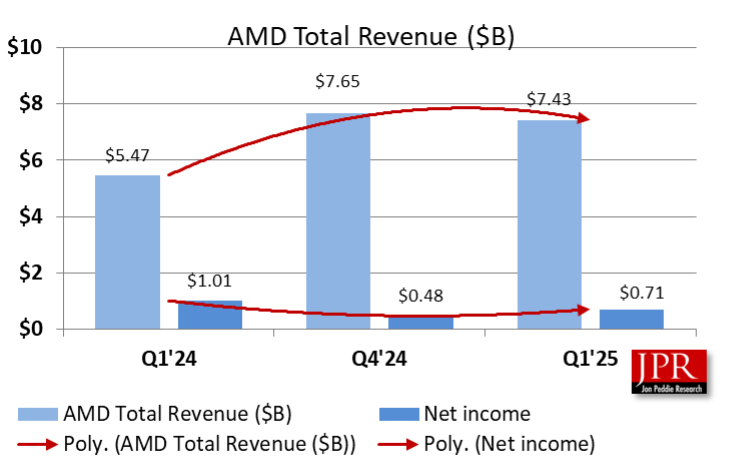

Amazon acquired 822,234 AMD shares ($84.4 million), not through direct purchase, but via AMD’s acquisition of ZT Group, where Amazon was a shareholder. AMD isn’t selling these shares and won’t receive proceeds. This news comes as AMD reported strong Q1 revenue of $7.44 billion, driven by data center growth. CEO Lisa Su addressed US export controls, noting they’re factored into projections. AMD also announced a 6.9 million share buyback, further boosting its positive market performance amid broader tech stock gains.

Amazon has acquired 822,234 shares of AMD worth $84.4 million, according to a 13F regulatory filing with the Securities and Exchange Commission on Tuesday.

AMD acquired ZT Group International, a server manufacturer, as part of its ongoing business expansion. As part of the acquisition, AMD issued shares to former ZT Group shareholders—including Amazon, which held an equity stake in ZT Group prior to the acquisition.

“We are registering the offer and sale of the shares of common stock owned by the selling stockholders to satisfy registration rights we granted to them pursuant to a stock purchase agreement…. We are not selling any shares of our common stock under this prospectus and will not receive any proceeds from the sale or other disposition of our common stock by the selling stockholders,” AMD stated in the regulatory filing.

AMD recently disclosed its financial performance for the first fiscal quarter, revealing revenues amounting to $7.44 billion. This figure surpassed the consensus estimates from financial analysts, who had projected revenues closer to $7.12 billion. A significant contributor to this robust performance was the company’s data center division, which experienced substantial year-over-year expansion, growing by 57% to reach $3.7 billion in revenue for the quarter.

In the course of AMD’s earnings conference call with investors and analysts, Chief Executive Officer Lisa Su directly addressed the persistent complexities and headwinds presented by United States export restrictions concerning shipments to China. She also spoke to the impending artificial intelligence diffusion regulations, which were scheduled to become effective on May 15. Su affirmed that these various limitations and potential impacts had already been incorporated into the company’s comprehensive total addressable market (TAM) forecasts for AI accelerator chips, a market AMD estimates to be valued at $500 billion.

“We are engaging in a very active dialog and collaboration with the government as they undertake the process of formulating and refining these regulations, and it is undeniably a delicate equilibrium to strike,” Su remarked during the call. She further underscored AMD’s unwavering dedication to the objective of ensuring that “United States-based AI companies continue to serve as the predominant global technology platforms.”

There are indications and reports suggesting that the Trump administration is currently contemplating revisions to the existing framework of AI export controls. These potential modifications could involve a paradigm shift towards a more globalized licensing system, one that would be structured upon bilateral agreements negotiated individually with various nations.

Looking ahead, AMD has provided guidance projecting its second-quarter revenue to be in the vicinity of $7.4 billion. This forecast also exceeds the prevailing expectations from financial analysts, who had anticipated revenues around $7.24 billion for the upcoming quarter. Concurrently, the company is preparing for an estimated $800 million in charges related to inventory adjustments and associated reserves, which are directly linked to the implementation of new export regulations.

Adding to the factors bolstering its positive stock price performance, the company recently disclosed the buyback of approximately 6.9 million shares of its common stock. The encouraging sentiment surrounding the company was further amplified by the impressive financial results reported for the first quarter, which clearly demonstrated a substantial leap in both sales figures and net profitability. Concurrently, broader trends within the market, such as the notable surge in technology stock valuations influenced by the establishment of new trade agreements, are also understood to have provided a favorable tailwind for AMD’s recent ascent, which has moved in tandem with the Nasdaq’s overall upward trajectory, signaling a renewed sense of confidence among investors concerning the technology industry.

LIKE WHAT YOU’RE READING? INTRODUCE US TO YOUR FRIENDS AND COLLEAGUES.