Intel’s third quarter highlighted momentum and rebuilding. Revenue increased 6%, supported by new partnerships and government backing. Intel and Nvidia are collaborating on data center and PC chips. Nvidia is investing $5 billion. Washington has allocated $8.9 billion in funding for U.S. semiconductor manufacturing, and SoftBank has added another $2 billion. In addition, Intel announced the release of Panther Lake processors and unveiled the Clearwater Forest architecture, along with a Crescent Island AI GPU. CEO Lip-Bu Tan stated that steady execution and AI demand are shaping Intel’s future.

Nvidia couldn’t stay out of the news if it wanted to. The company has been making deals and fine-tuning its restructuring, but it all felt positive and received favorable reviews from all corners of the market. Nobody wants a weak Intel.

Intel and Nvidia announced a collaboration to develop multiple generations of custom products for the data center, PC, and enterprise markets. The partnership combines Intel’s CPU technologies and x86 ecosystem with Nvidia’s AI and accelerated computing platforms through NVLink integration. Nvidia will invest $5.0 billion in Intel common stock as part of the deal.

Intel and the U.S. administration outlined an $8.9 billion federal funding plan to expand domestic semiconductor manufacturing and strengthen U.S. technology leadership. During the quarter, Intel received $5.7 billion in government disbursements.

SoftBank Group invested $2.0 billion in Intel common stock, signaling alignment with Intel’s goal to increase advanced semiconductor capacity and manufacturing infrastructure within the United States.

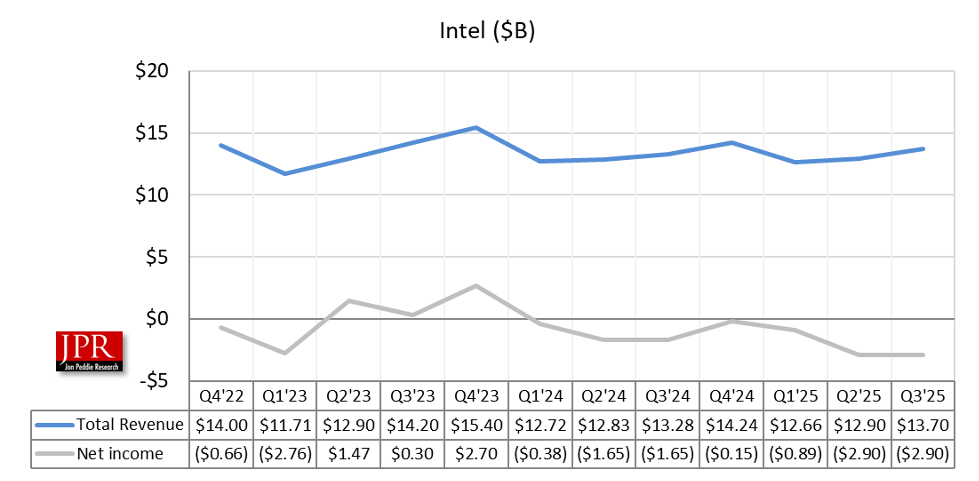

Third-quarter revenue was $13.7 billion, up 6.2% from the last quarter and up 3.2% from the same quarter last year.

The company is forecasting fourth-quarter 2025 revenue of $12.8 billion to $13.8 billion.

“Our Q3 results reflect improved execution and steady progress against our strategic priorities,” said Lip-Bu Tan, Intel CEO. “AI is accelerating demand for compute and creating attractive opportunities across our portfolio, including our core x86 platforms, new efforts in purpose-built ASICs and accelerators, and foundry services. Intel’s industry-leading CPUs and ecosystem, along with our unique U.S.-based leading-edge logic manufacturing and R&D, position us well to capitalize on these trends over time.”

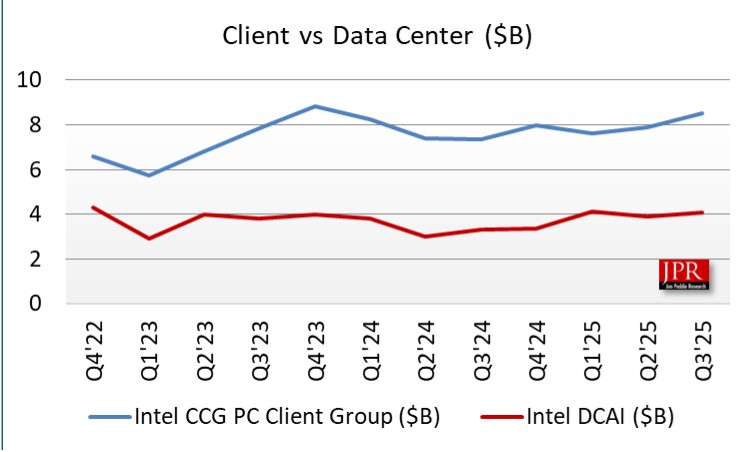

Intel announced the architecture of its Intel Core Ultra Series 3 processors, codenamed Panther Lake, marking the first client SoCs built on the Intel 18A process. The company expanded its partnership with Microsoft to integrate Windows ML and connect Intel vPro manageability with Microsoft Intune, enhancing deployment and security operations across enterprise PCs.

Intel also introduced its next-generation server platform, the Intel Xeon 6+ (code-named Clearwater Forest), built on Intel 18A and designed to improve compute throughput and energy efficiency in high-density data centers. At the same time, Intel revealed details of a new inference-optimized GPU, code-named Crescent Island, aimed at token-based cloud services and enterprise-scale AI workloads.

What do we think?

A six-percent gain in Q3 from Q2 isn’t very impressive, but maybe it’s okay in this crazy, volatile market. Dealing with tariff issues, late-to-market products, new relationships, and their potential impacts on products, brands, and people—all while major competitors get stronger—is a lot to handle.

Despite the new funding, Intel’s contract manufacturing division continues to pressure earnings.

Intel Foundry, its dedicated chipmaking unit, posted $4.2 billion in revenue, down 2% year over year. The group reported an operating loss of $2.3 billion (most of Intel’s $2.9 billion loss for the quarter), reflecting increased expenses tied to scaling production capacity and advancing new fabrication technologies across multiple sites.