The AI GPU story started in 2018 with US export restrictions on chips to China. Then came Moore Threads, a Beijing start-up led by an ex-Nvidia expert, advancing with fabless AI GPUs. Their launch on the Shanghai STAR Market on trading day saw the company’s shares surge more than fivefold to 650 yen (≈ US$91.90), closing at 600.5 yen after a dip, earning 8 billion yen with a high 100× sales multiple—much higher than Nvidia’s. They aim for 1.5 billion yen in revenue by 2025 and profits by 2027, driven by local demand avoiding H20 bans. China’s strategy? Replace Nvidia with domestic options like MetaX; group slower chips to match H20 or MI308 power. DeepSeek already developed efficient AI software—now hardware is catching up, targeting global exports. Nvidia’s Jensen Huang warns that if rivals take China, they’ll distribute AI worldwide.

The AI GPU wars started in 2018. At that time, the United States began imposing stricter export restrictions on semiconductor firms seeking to sell their chips to China—those rules aimed to slow China’s drive to build its own advanced chipmaking industry.

Moore Threads, a Beijing-based GPU designer founded by a former Nvidia executive, plays a key role in China’s semiconductor localization strategy and concentrates on data center and AI workloads in a fabless model similar to Nvidia.

At its debut on the Shanghai STAR Market, the company’s shares surged more than fivefold during the trading day, opening at 650 yen ($91.90) and closing at 600.5 yen after dipping to a low of 556 yen, reflecting strong demand from domestic investors. The opening price indicated a market capitalization of roughly 305 billion yen, placing Moore Threads among the larger companies on the tech-focused STAR Market and underscoring expectations for rapid growth in China’s GPU ecosystem.

The IPO raised roughly 8 billion yen by selling 70 million shares at an offering price of 114.28 yen, a level that already valued the company at more than 100 times trailing sales, compared with a materially lower multiple for Nvidia. This valuation reflects a forward-looking view of Moore Threads’ roadmap rather than its current performance, since the company’s GPUs lag Nvidia’s in capability and software ecosystem depth. Moore Threads projects revenue of 1.2 billion to 1.5 billion yen in 2025, with the upper estimate implying a year-over-year increase of about 242%, and targets its first profitable year no earlier than 2027. These projections rest on continued demand from Chinese cloud providers, Internet platforms, and industrial users that are shifting procurement to domestic GPU vendors in response to US export controls and national policy incentives. The Moore Threads listing also provides a reference point for other Chinese GPU start-ups preparing offerings in Shanghai and Hong Kong, including MetaX, which recently set its own IPO price in the same market, signaling a broader capital-markets push to fund an indigenous GPU and AI accelerator stack.

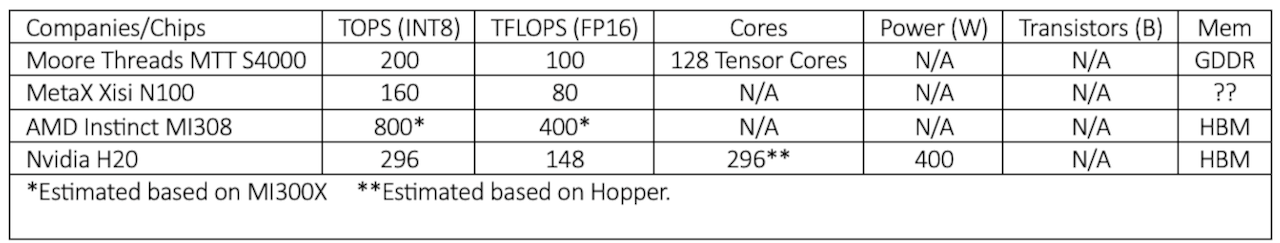

From August to November 2025, Chinese authorities urged domestic firms—particularly those linked to the state and involved in government projects—to avoid Nvidia’s export-compliant H20 GPUs and instead support local AI chip development. Based on the comparison chart, it’s unlikely that MetaX or Moore Threads will directly replace AMD or Nvidia for high-performance AI processors. Perhaps by combining two or three S4000s, they could achieve performance similar to an H20 or M308, but at what power cost?

Table 1. Comparison of Chinese and US AI GPUs.

China’s government wants its firms to replicate in hardware the success they have already achieved in software and to find ways around America’s restrictions. In January, DeepSeek, a Chinese software company, introduced an AI model that matched Western rivals while using only a fraction of the computing resources. Chinese chipmakers pursue a comparable approach, pushing design tools beyond previous boundaries, assembling large processor clusters to compensate for slower individual chips, and tightly coupling hardware with software to extract maximum performance. The key challenge lies in China’s ability to integrate chips, systems, and code into a unified, competitive AI ecosystem.

China will soon seek to export its artificial intelligence technologies worldwide, with visions such as an AI version of its Belt and Road infrastructure initiative, if American companies let Chinese competitors like Huawei run away with the market, said Nvidia CEO Jensen Huang.

Huang warned that abandoning the Chinese market to domestic players will leave room for China to export advanced technologies to other countries.

“We should also acknowledge that Huawei is one of the most formidable technology companies the world has ever seen,” said Huang. “We compete with this company. They’re formidable. They’re agile. They move incredibly fast.”

We’re tracking this dynamic and expanding market of AI processors with our AI Processor Market Development Report, which is a comprehensive overview of technology, the market size with projections, the participants’ technology trends, and strategic outlook through 2035. This 396-page report contains 255 figures and 158 tables. If AI processors are something you are interested in, give us a call or send Jon an email ([email protected]).

LIKE WHAT YOU SAW HERE? SHARE THE EXPERIENCE, TELL YOUR FRIENDS.