Nvidia is creating export-compliant AI chips for China, adapting its Blackwell architecture under US restrictions. The B30A targets training, with half the power and memory of the B300 but retains NVLink, using TSMC’s CoWoS-S packaging for lower costs. The RTX 6000D, a reduced version of existing GPUs, serves inference and visualization. President Trump proposed conditional exports with revenue sharing. Despite domestic push by Huawei and state mandates, Nvidia seeks to sustain its 13% China revenue share.

Nvidia is developing an AI processor tailored for the Chinese market, according to Reuters. The effort builds on the company’s Blackwell architecture while accounting for US export restrictions. Reports indicate multiple chip variants are in progress to sustain Nvidia’s presence in China under shifting regulatory conditions.

Politicians and businesspeople trying to hear rumors.

The B30A chip targets training workloads for Chinese customers. It uses a single-die architecture that delivers about half the computational capacity of the flagship B300 accelerator. The design incorporates 144GB of HBM3E memory, or 50% of the B300’s memory resources. Engineers retained NVLink interconnect functionality to enable multiprocessor scaling, similar to the H20 model. Consolidating components into a single die simplifies manufacturing and ensures compliance with export thresholds.

Production of the B30A is expected to use TSMCs CoWoS-S packaging method. This design will accommodate one compute chiplet and four HBM3E stacks, lowering costs relative to the CoWoS-L packaging used in Nvidia’s dual-chiplet B200 and B300 designs. The simplified configuration supports streamlined manufacturing while maintaining performance appropriate for export compliance.

In parallel, Nvidia is designing the RTX 6000D for inference workloads and professional visualization tasks. This processor relies on GDDR memory, achieving a bandwidth of 1,398 GB/s. The figure is intentionally below the 1.4TB limit imposed by US restrictions issued in April.

The RTX 6000D is a reduced-capability version of existing RTX 6000 products, with simplified specifications intended to reduce cost and remain compliant. Sample shipments to Chinese clients are planned for September, with possible commercial release between late 2025 and early 2026.

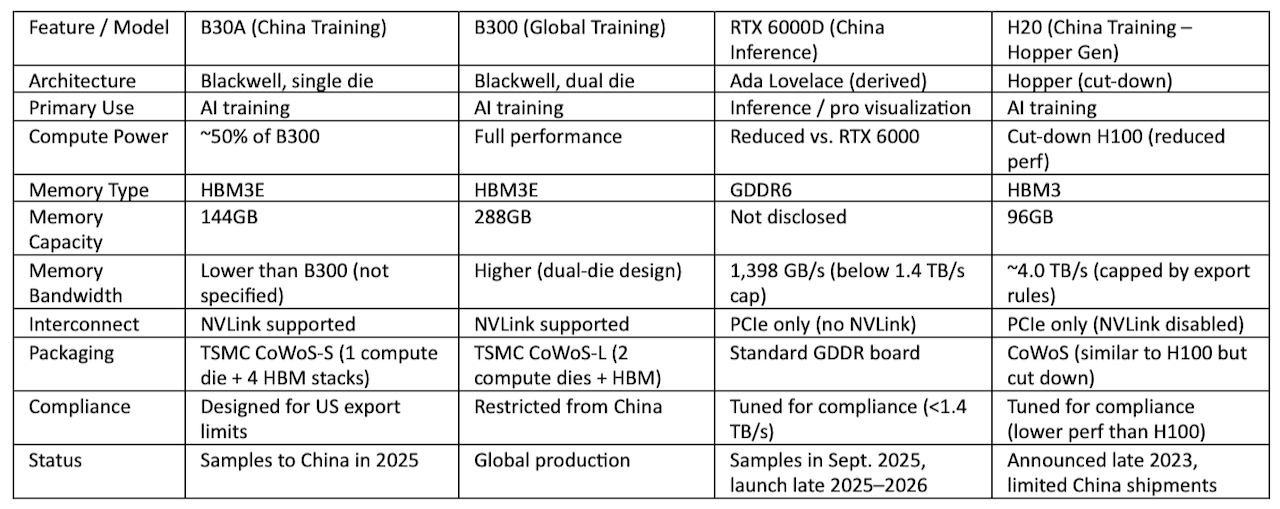

Table 1. Nvidia AI and GPU variants for China.

President Trump signaled that Nvidia chip sales to China may proceed under conditional terms. He referenced an arrangement requiring Nvidia and AMD to remit 15% of Chinese revenue to the US government to secure export licenses. Trump described potential restrictions reducing computing power by 30% to 50% compared to leading models, calling the current H20 “obsolete.” Commerce Secretary Howard Lutnick confirmed ongoing discussions with Nvidia CEO Jensen Huang, while emphasizing presidential authority over final approval.

Meanwhile, China continues to promote domestic semiconductor development to reduce its reliance on foreign suppliers. Government mandates require state-owned data centers to obtain more than 50% of chips from domestic vendors (see story here). Shanghai officials and national regulatory agencies oversee implementation. State media have raised concerns over potential security vulnerabilities in Nvidia chips, though Nvidia has denied the presence of backdoors or unauthorized access features.

Huawei has advanced local chip projects, with certain devices achieving performance levels comparable to those of Nvidia products in specific tasks. Analysts, however, note limitations in software ecosystem support and memory bandwidth. These gaps preserve Nvidia’s competitive advantage but reinforce China’s motivation to accelerate domestic development.

China represented 13% of Nvidia’s revenue in the prior fiscal year. Nvidia resumed sales of its H20 product in July following regulatory clearance after an earlier suspension. Company officials emphasize that retaining Chinese developers within Nvidia’s hardware and software platforms helps prevent migration to competitors, such as Huawei.

Nvidia expects to provide B30A samples to Chinese customers within the next month for evaluation. Broader deployment depends on regulatory approval, with availability potentially extending into 2026. These efforts demonstrate Nvidia’s efforts to maintain engagement in China while complying with export regulations and adapting to geopolitical constraints.

LIKE WHAT YOU’RE READING? INTRODUCE US TO YOUR FRIENDS AND COLLEAGUES.