Pixelworks is turning a page in its story. The company plans to sell its Shanghai semiconductor unit to VeriSilicon for about $133 million, expecting $50–$60 million in cash after costs. The move isn’t a retreat—it’s a refocus. By streamlining operations, Pixelworks can concentrate on what it does best: display processing, video delivery, and its TrueCut Motion technology. CEO Todd DeBonis says the sale strengthens the company’s foundation for future growth, with the deal expected to close by late 2025.

The company hopes to improve its financial position, simplify its corporate structure, and focus on its core business.

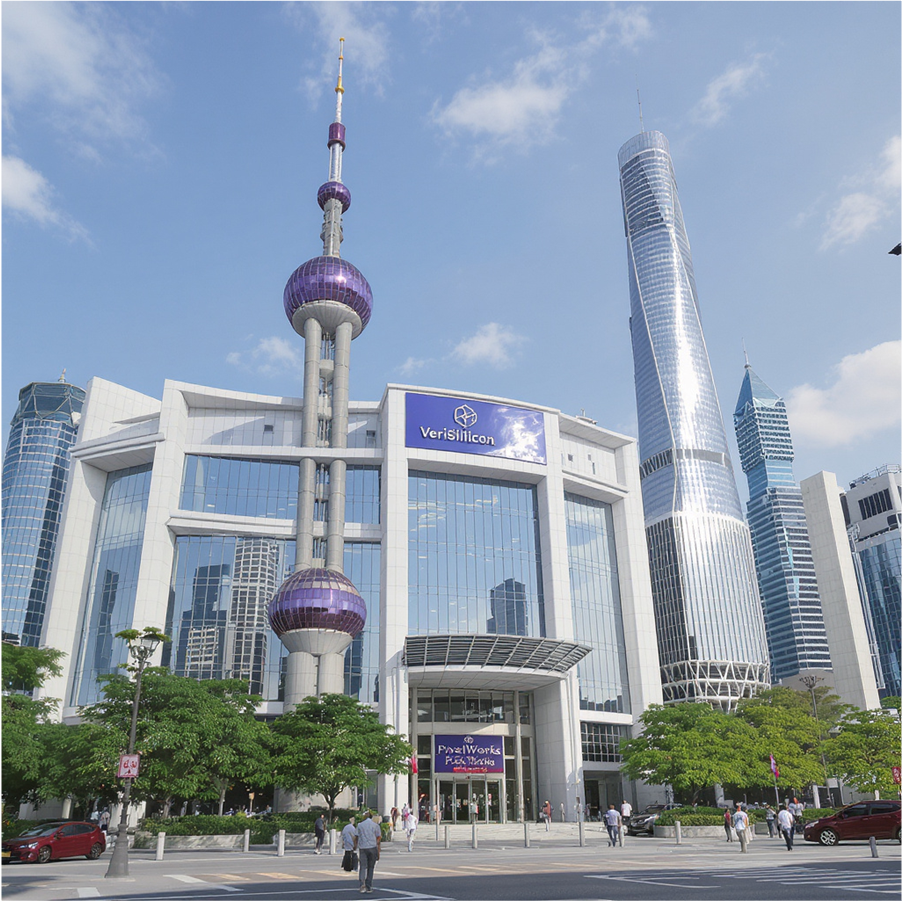

Pixelworks Inc. signed a definitive agreement to sell its shares in Pixelworks Semiconductor Technology (Shanghai) Co. Ltd. to a special purpose entity led by VeriSilicon Microelectronics (Shanghai) Co. Ltd. The transaction values 100% of Pixelworks Shanghai at RMB 950 million (~$133 million). After adjusting for transaction costs, withholding taxes, and share transfers with other shareholders, Pixelworks expects to receive between $50 million and $60 million in cash upon closing.

The agreement follows a strategic review of Pixelworks’ structure and asset allocation. Management concluded that transferring control of the Shanghai subsidiary provides the most effective way to extract value for shareholders while enabling both companies to focus on their core strengths. Pixelworks will use the proceeds to strengthen operations and support its display processing, video delivery, and TrueCut Motion businesses.

Pixelworks and its co-investors also agreed to cancel certain repurchase rights and realign ownership stakes to simplify governance and facilitate the sale. The transaction requires approval by at least 67% of Pixelworks common shareholders and compliance with standard regulatory conditions.

President and CEO Todd DeBonis stated that the sale advances Pixelworks’ restructuring plan by monetizing non-core assets and reinforcing the company’s focus on mobile visual processing technology. The board of directors approved the transaction unanimously. Pixelworks anticipates completing the sale by the end of 2025 and continuing development of display processors, video technologies, and content motion enhancement systems for global customers.

What Do We Think

Pixelworks is still in operation, but it is undergoing a significant strategic restructuring by selling its Shanghai subsidiary. The company is using the proceeds to refocus its core business on its remaining global mobile display processing, video delivery, and TrueCut Motion technologies.

TrueCut Motion is described by the company as motion grading, which gives filmmakers shot-by-shot control in video editing to maintain the cinematic look and feel on every screen.

The company’s strategy is to use these funds to support its ongoing core businesses, which include mobile display processing, video delivery solutions, and its TrueCut Motion platform. Pixelworks continues to operate and develop technology, as shown by recent integrations of its processors into new smartphone models and its ongoing focus on developing its other core businesses.