Jon Peddie Research reports that the growth of the global PC-based graphics processor unit (GPU) market reached 70 million units in Q1’24, and PC CPU shipments increased a surprising 33% year over year, the second year-over-year increase in two and a half decades.

Overall, GPUs will have a compound annual growth rate of 3.6% during 2024–2026 and reach an installed base of almost 3 billion units at the end of the forecast period. Over the next five years, the penetration of discrete GPUs (dGPUs) in the PC will be 22%.

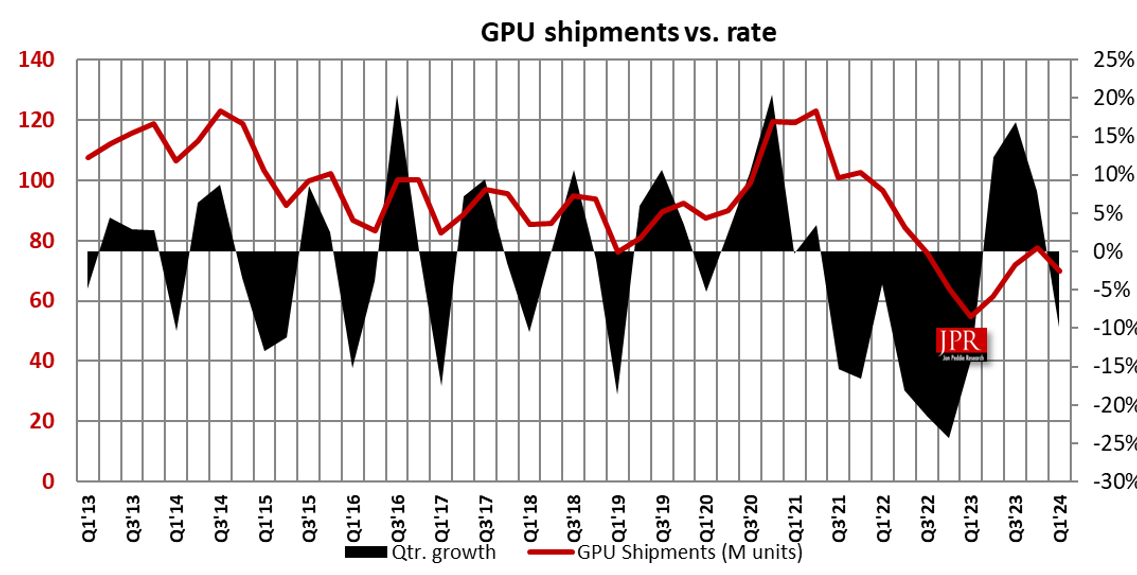

Year-to-year total GPU shipments, which include all platforms and all types of GPUs, increased by 28%, desktop graphics decreased by -7%, and notebooks increased by 38%.

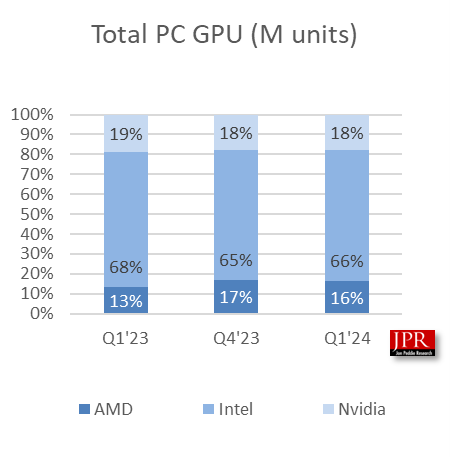

AMD’s overall market share decreased by -0.7% from last quarter, Intel’s market share increased 0.3%, and Nvidia’s market share increased by 0.4%, as indicated in the following chart.

Overall, GPU unit shipments decreased by -9.9% from last quarter; AMD’s decreased by -13.6%, Intel’s decreased by -9.6%, and Nvidia’s decreased by -7.7%.

- The GPU’s overall attach rate (which includes integrated and discrete GPUs, desktops, notebooks, and workstations) in PCs for the quarter was 113%, down -0.6% from last quarter.

- Desktop graphics add-in boards (AIBs that use discrete GPUs) decreased by -14.8% from the last quarter.

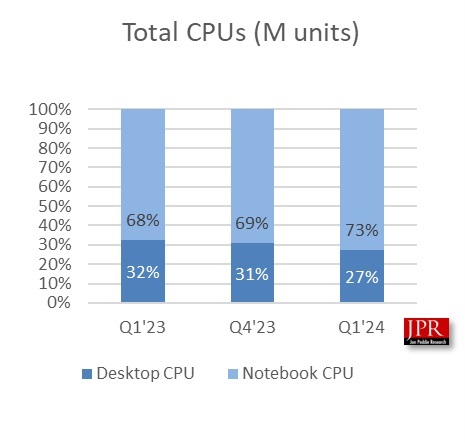

- The overall PC CPU market decreased by -9.4% quarter to quarter and increased by 33.3% year to year.

The first quarter is typically flat to down compared to the previous quarter. This quarter’s dGPUs were down -12.4% from the last quarter, which is below the 10-year average of -11%.

“Although the first quarter was down, it may be a signal the industry is returning to a normal seasonality,” said Dr. Jon Peddie, president of Jon Peddie Research. “Microsoft, AMD, and Intel are promoting the AI PC, and Lenovo says their sales are up because of it. AMD and Nvidia are forecasting an up Q2, so we may have a surprise, and traditional seasonality may be skewed again. However, AMD and Nvidia’s forecast includes the data center. We expect Nvidia, with its leading market share, to ship well over 2 million data center GPUs in 2024.”

GPUs and CPUs are leading indicators of the PC market because they go into a system while it’s being built, before the suppliers ship the PC. However, most of the semiconductor vendors are guiding down for the next quarter an average of -7.9%. Last quarter, they guided 7%, which was too low. The 10-year average for Q3-to-Q4 shipments is 0.9%, so happy days may not be completely here just yet. However, some organizations’ reading of the tea leaves sees the two consecutive quarters of growth as the harbinger of a fantastic 2024, just like they saw the Covid demand for Chromebooks as the beginning of an explosive demand for Chromebooks—that hasn’t quite happened yet.

The new Q1’24 edition of Market Watch contains the above information and more. For easier consumption, we have changed the report’s format from a heavily narrated version to a heavily charted version. We have also added server and client CPU shipment data back to Q1’21 and GPU-compute (GPGPU) shipment data back to Q1’21 for AMD, Intel, and Nvidia. We have expanded the pivot data array to include those devices.

JPR also publishes a series of reports on the graphics add-in board market and PC gaming hardware market. The latter covers the total market, including systems and accessories, and examines 31 countries.

Pricing and availability

JPR’s Market Watch is available now, and a single issue sells for $3,000. This report includes an Excel workbook with the data used to create the charts, the charts themselves, and supplemental information. The annual subscription price for JPR’s Market Watch is $6,000 and includes four quarterly issues. Full subscribers to JPR services receive TechWatch (the company’s exclusive access to daily news).

Click here to view the executive summary, table of contents, and more about this significant report or to download it now. For more information, call (415) 435-9368 or visit the Jon Peddie Research website at www.jonpeddie.com. Contact Robert Dow at JPR ([email protected]) for a free sample of TechWatch.

About Jon Peddie Research

Jon Peddie Research has been active in the graphics and multimedia fields for more than 30 years. JPR is a technically oriented multimedia and graphics research and consulting firm. Based in Tiburon, California, JPR provides consulting, research, and other specialized services to technology companies in various fields, including graphics development, multimedia for professional applications and consumer electronics, high-end computing, and Internet-access product development. JPR’s Market Watch is a quarterly report focused on PC graphics controllers’ market activity for notebook and desktop computing.

Company Contact:

Jon Peddie, Jon Peddie Research

(415) 435-9368

[email protected]

Robert Dow, Jon Peddie Research

(415) 407-0757

[email protected]

Media Contact

Carol Warren, Creor Group

(714) 890-4500

[email protected]

JPR’s Market Watch is a trademark of Jon Peddie Research. All other trade names and trademarks referenced are the property of their respective owners.