The competitive landscape in workstations is stronger than it’s been in nearly two decades. For the first time since the mid-2000s, the industry can count not one but two genuinely viable suppliers for each of the workstation’s primary components: Intel and AMD in CPUs and Nvidia and AMD in discrete professional GPUs (with Intel currently auditioning to be the third in GPUs). And in contrast to many points over that span, all today are arguably putting their best foot forward at the same time, without any stark weaknesses in their product lines.

Furthermore, top OEMs Dell, HP, and Lenovo (DHL) have all diversified their offerings to tap into that competitive pool of silicon, while at the same time, investing in conscientious differentiation of wares, particularly in robustness, ease of access, and thermal and acoustic engineering. Rounding out supplier options, the industry maintains a vibrant pool of smaller, nimble workstation OEMs and system integrators to serve the needs of virtually every corner of the professional computing landscape.

All that makes for a timely opportunity to sample workstation products across the market’s ever-widening range, from the high-performance yet svelte mobile workstations, up through the deskside ranks, to the bar-breaking capabilities that a top-end workstation can deliver. These include:

- Dell’s Precision 5680 mobile workstation—The industry leader’s premier model offering solid 13th Gen Core performance in a thin and light package.

- HP’s Z4 G5—A Premium-class deskside tower built around Intel’s (overdue) refresh of its Xeon W-2000 family.

- HP’s Z6 G5 A—An Ultimate-class deskside tower based on AMD’s latest Ryzen Threadripper Pro 7000WX series CPUs, with performance scaling up to an industry-leading 96 cores.

A state-of-the-art sample of the thin/performance mobile workstation class: Dell’s Precision 5680 with 13th Gen Core mobile CPU

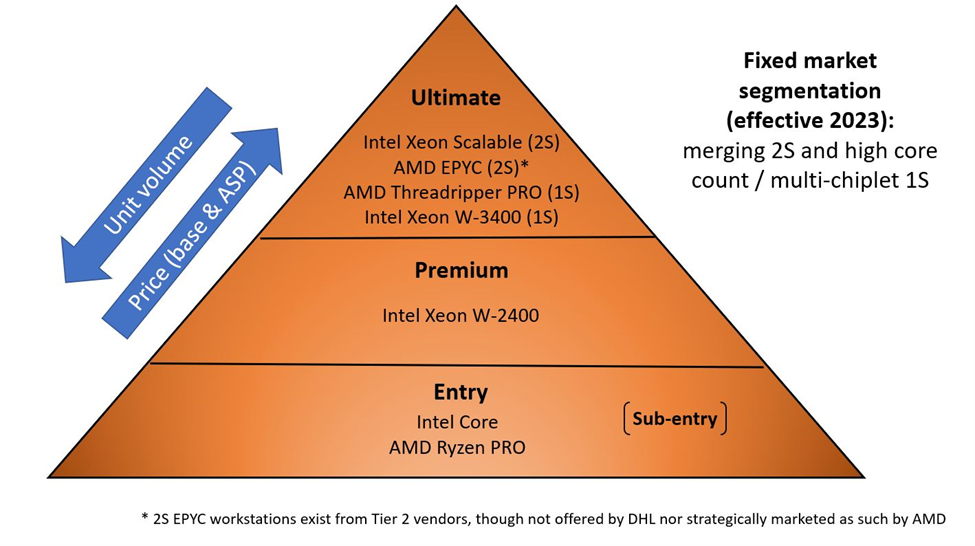

In today’s workstation market, mobiles outship stationary models around 45%–55%, a stark contrast from the 2010s, where fixed workstations held a 2:1 volume advantage. The pandemic years flipped the market upside down, with the mobile’s superior aptitude for remote and hybrid work increasing its popularity dramatically in the years from 2019–2022. In virtually any class of product, as volume grows, so also expands the variety of available form factors and configurations. The mobile workstation market is no exception, and its growth spurt has spawned a range of product types even broader than the traditional desktop segment.

In tracking the market for the JPR workstation report series, I segment today’s market along two primary axes: first, in the machine’s balance of mobility versus performance, and second, across display sizes. In the former, four primary classes are defined:

- Sub-entry/Low Power—Leaning to the lightest, smallest package consuming minimal power.

- Price/Performance—The meat of the market serving more traditional workstation users interested in optimizing performance without breaking budgets.

- Thin/Performance—Targeting that portion of the core user base looking for performance but willing to pay a bit of premium to get it in a more mobile package.

- Performance—The segment in which performance and productivity is the overriding criterion.

These segments tend to all map directly to Intel’s power tiers in their Core processor lineup serving laptops and mobile workstations, hence the suffixes: U/P (15W /28W), H (45W), and HX (55W). AMD has also recently cracked the Lenovo and HP workstation lines with Ryzen Pro mobile CPUs, which naturally tend to fit the same power envelopes.

| 14 inch | 15 inch | 16 inch | 17 inch | |

| Sub-entry/Low Power (U/P) | Dell Precision 3480 HP ZBook Firefly 14 P14s | Dell Precision 3580 | HP ZBook Firefly 16 Lenovo ThinkPad P16s | – |

| Price/Performance (H) | Dell Precision 5480 | Dell Precision 3581 HP ZBook Power | Lenovo ThinkPad P16v | – |

| Thin/Performance (H) | – | – | HP ZBook Studio Lenovo ThinkPad P1 Dell Precision 5680 | – |

| Performance (HX) | – | – | Dell Precision 7680 HP ZBook Fury Lenovo ThinkPad P16 | Dell Precision 7780 |

Table 1: How current mobile workstation offerings from Dell, HP, and Lenovo fit JPR mobile workstation market segments and display sizes.

Along the display size axis, the longtime majority sweet spot of the market, the 15.6-inch screen, has splintered into both a 16- and 14-inch class, entertaining those with a desire for a touch larger (and 16:10 aspect) screen as well as those looking for absolute minimum physical footprint. At the top end remains the 17.3-inch screens for those looking for maximum on-the-road productivity. Not surprisingly, the 14-inch popularity tends to align quite closely with the Sub-Entry/Low Power customer base prioritizing mobility, while 16- and 17-inch screens ship more of those models serving performance-oriented buyers.

Dell’s most recent Thin/Performance entrant is the Precision 5680, offering higher-end performance within a thinner (0.8–0.87-inch front-rear) profile than available in the Price/Performance class (typically closer to 1 inch). That sleek form factor comes coupled with an ample 16-inch display with 3840×2400 OLED option, along with all the advanced professional-focused features one would expect in a premium mobile workstation, for example: vPro, fingerprint reader, and access to professional discrete Nvidia RTX GPUs.

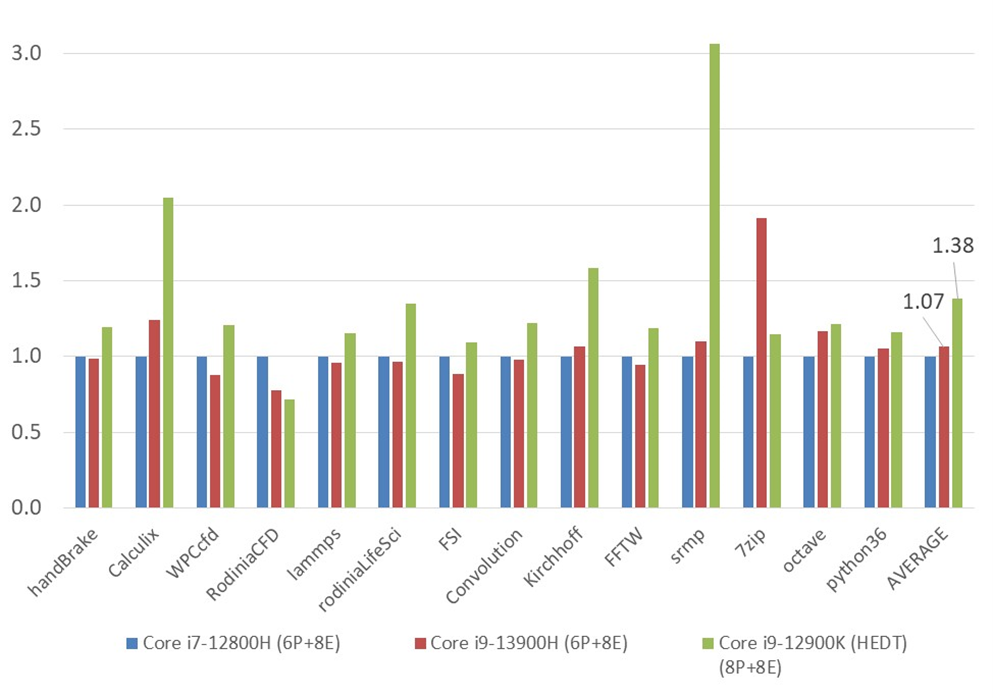

Focusing here on CPU performance, the Precision 5680’s 13th Gen Core i9-13900H outperforms a comparable 12th Gen Core i7-12800H (with the same core count and type, supported by similar memory, I/O, and graphics capabilities) by around 7% on the SPECworkstation 3.0.4 benchmark’s battery of CPU-specific tests.

A few things to point out, most notably is that the results here compare a 13th Gen Core H-class (45W TDP) SKU with a 12th Gen Core H-class SKU with the same number of cores—in this case, 14 (with six performance-oriented P-cores and eight efficiency-focused E-cores). The 13th Gen Core’s overall improved power efficiency allowed the top-end performance-class HX (55W TDP) SKUs to move up to 24 cores (8P/16E), which would no doubt deliver a significantly larger performance margin over 12th Gen Core than the 7% measured here.

What’s in a CPU name? Often, quite a lot

The chart above contrasting the performance of comparable mobile 12th Gen and 13th Gen Core CPUs includes one additional column: the 12th Gen Core i9-12900K. For those not intimately versed in which letters Intel appends to its SKU numbers, an i9-13900H might seem like a generational step forward from an i9-12900K, or at least close. But it turns out there’s a huge difference between the H and the K. As noted above, the H designates a 45W TDP for higher-performance mobiles, while the K refers to a high-end desktop (HEDT) CPU with a 125W TDP, with frequencies unlocked for overclocking (mostly for gamers). So, these two are certainly not close siblings with only modest differences in capability, but rather distant cousins with little resemblance when it comes to potential performance. (For what it’s worth, the same ambiguity in numbering across mobile and fixed segments is prevalent with both GPUs and other vendors like AMD and Nvidia.)

The HEDT CPU’s larger power envelope allows for significantly higher frequencies, which, in turn, translates to far higher performance, as evidenced by the previous-generation i9-12900K’s dramatic edge in benchmark scores over both comparable 12th and 13th Gen Core mobile SKUs. Bear in mind, a CPU like a 13th Gen Core i7 or i9 represents the Entry class when it comes to fixed, deskbound workstations, with a lot of headroom above in Premium- and Ultimate-class models.

A 2024 snapshot of an Ultimate-class fixed workstation: HP’s Z6 G5 A with AMD Ryzen Threadripper Pro 7000WX series CPUs

No doubt, the mobile workstation represents the best compromise of mobility and capability for professionals in design, manufacturing, digital media and entertainment, medical, geoscience, and more—emphasis on “compromise.” Because while the fixed workstation obviously can’t compare to a mobile workstation with respect to mobility, the latter pales in comparison to what a fixed machine can achieve when the overriding goal is performance. And the reason why is both simple and undeniable, bound by physical laws: The more mobile the machine, the less power available and the less the commensurate thermal output consuming that power can be effectively dissipated (i.e., thermal design power, or TDP). Conversely, the less mobile the machine needs to be, the higher the power that can be both delivered and dissipated. A line-powered chassis with a larger volume can, all else being equal, outperform a battery-powered (at least part-time) mobile with scant space for cooling.

To illustrate the full breadth of the gap in available performance, let’s jump to the top end of today’s available workstation CPU performance: AMD’s Threadripper Pro 7000WX series, showcased in new Ultimate-class workstations from all the Tier 1 triumvirate: Dell’s Precision 7875, HP’s Z6 G5 A, and Lenovo’s ThinkStation P6.

| Processor | Cores/ Threads | Base/Boost Frequency (GHz) | Total cache | TDP (Watts) |

| Ryzen Threadripper Pro 7995WX | 96/192 | 5.1/2.5 | 480MB | 350 |

| Ryzen Threadripper Pro 7985WX | 64/128 | 5.1/3.2 | 320MB | 350 |

| Ryzen Threadripper Pro 7975WX | 32/64 | 5.3/4.0 | 160MB | 350 |

| Ryzen Threadripper Pro 7965WX | 24/48 | 5. /4.2 | 152MB | 350 |

| Ryzen Threadripper Pro 7955WX | 16/32 | 5.3/4.5 | 80MB | 350 |

| Ryzen Threadripper Pro 7945WX | 12/24 | 5.3/4.7 | 76MB | 350 |

Table 2: Primary specifications of AMD Ryzen Threadripper Pro 7000WX series workstation CPUs.

The 7000WX series (at 350W TDP) retains the breadth of available CPU core counts of the preceding 5000WX line to serve the full range of workstation-caliber workloads and computing professionals’ budgets: from the 12-core 7945WX to the 64-core 7985WX. And with the 7000WX series generation, Threadripper Pro expands the performance scaling envelope a significant step further, raising the industry bar to 96 cores with the 7995WX.

Joining the fixed family of HP workstations, the Z6 G5 A exhibits the vendor’s established Z DNA both on the surface and beneath. From the outside, the common look and feel is obvious with respect to both aesthetics and burly construction. The ubiquitous Z chassis top handle is integrated, of course—perhaps at first glance a seemingly trivial feature but one that proves its outsized value to IT personnel responsible for deployment and maintenance. Inside, HP’s comprehensive, conscientious attention to tool-less access not only means no screws or drivers, but is remarkably robust as well. Removing CPU and memory fans to access a CPU cooler or add DIMMs requires pressing two fingertip tabs. Ditto for releasing compression on the PCIe add-in brackets at the bulkhead, and one finger to relieve often overlooked retention at the board’s rear. No question, for those who need to get at the internals any more often than once—swapping CPUs and GPUs, adding memory or storage—the Z’s thoughtful chassis design will certainly please.

But the Z6 G5 A’s chief bragging right is the one we’re focused on here: the Threadripper Pro 7000WX series CPU. Putting its best possible foot forward, HP outfitted a JPR review unit with the 96-core 7995WX, delivering 50% more cores than the previous-generation 5000WX series, raising the bar considerably on the maximum core count available within a single CPU socket. (Worth noting, I also had available a very similarly outfitted Threadripper Pro platform with other 7000WX SKUs available.) Given that test results of the 7995WX in both that platform and the Z6 G5 A were very consistent, and in the interest of gaining a greater breadth of results across SKUs while ensuring consistency and equity, the benchmarking results to follow are based on that platform, not the Z6 G5 A. (There is every reason to expect the Z6 G5 A would deliver comparable results across the board.)

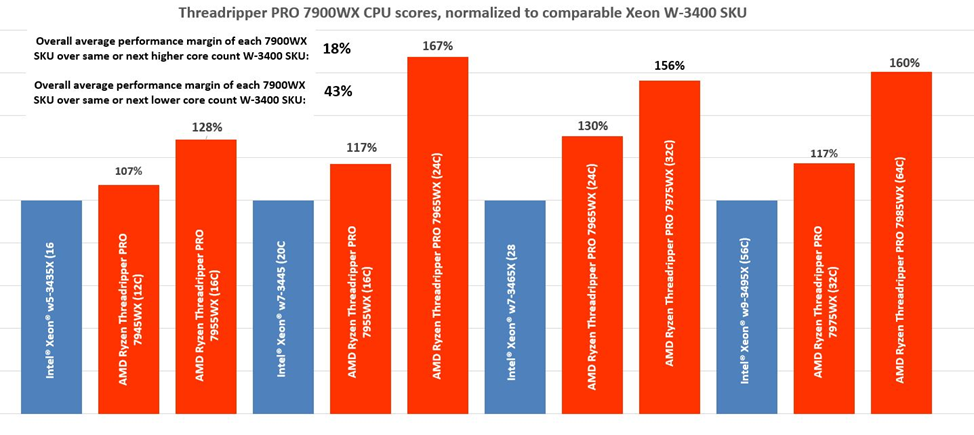

Comparing Threadripper Pro with Intel’s most recent and comparable offering, the Xeon W-3400 line, is less than straightforward. Both support eight memory channels of similar bandwidth, but the two lines’ SKUs vary with respect to number of cores—they overlap at a few counts but not all and not up at the higher end where the performance is likely to vary the most. Accordingly, I evaluate the two lines’ performance in this way: For each W-3400 SKU (four of which I had available), I compare two closest 7000WX SKUs, one with the same or next lower core count, and one with the next higher count. For each, I ran a battery of SPECworkstation 3.1 CPU-specific tests, Cinebench R23 (multithreaded/MT mode), Blender Cycles 3.0.6, and PassMark Performance Test (a geomean composite of all MT tests). While these tests are designed to isolate the CPU and memory subsystem, the two systems’ GPUs and I/O were ensured to be very similar, if not identical, in performance.

On average, across the full set of tests comparing each 7000WX SKU with the same—or next lower—core count SKU of the Intel Xeon W-3400 family, the 7000WX managed up to 43% higher scores. Comparing each 7000WX series SKU with the same or next higher core count Intel Xeon W-3400 SKU, Threadripper Pro managed to score around 18% higher.

A (finally) upgraded Premium-class fixed workstation: HP’s Z4 G5 with Xeon W-2400 series CPUs

Despite AMD’s obvious advances in technology, performance, and market share in PC and server markets, Intel remains the dominant CPU supplier for workstations serving CAD markets. While AMD has successfully taken bites out of Intel’s share in workstations with its Threadripper Pro and Ryzen Pro lines—both of which have earned Tier 1 OEM support—Intel retains dominant share today. Notably, it’s managed to hang on to that share despite uncharacteristic stumbles in execution and lagging refresh cycles.

In 2023, Intel managed to finally upgrade not one, but its entire trio of workstation-focused CPU lines: Core at the entry level, Xeon W at the midrange and above, and Xeon Scalable at the dual-socket top end. In particular, Xeon W (single-socket primarily for workstations) and Xeon Scalable (2S+ for servers primarily but also top-end workstations) were sorely in need of revamping. Yes, Core lost some competitiveness earlier this decade, due in part to Intel’s acknowledged struggles with advanced manufacturing processes. But Intel was quicker to right that ship, with the 12th and 13th Gen returning Core to its position as the CPU to beat at the entry level. At the top end, the dual-socket-capable Xeon Scalable had stagnated, but with the dual-socket workstation segment shrinking, now representing an increasingly small market niche, any loss in Xeon Scalable competitive edge would barely show up in Intel’s workstation CPU volume.

Rather, Intel’s glaring competitive hole in its workstation CPU portfolio had been Xeon W, the line serving the Premium midrange fixed segment of the market. Entering 2023, the Xeon W-2200 product generation was still anchoring Tier 1 (Dell/HP/Lenovo) OEMs’ premium workstation models, nearly four years after launch. (There had been one intermediate refresh, but for several reasons was not picked up at the Tier 1 level.)

Finally, the long-anticipated 2023 arrival of the Sapphire Rapids generation of Xeon remedied that situation. Garnering more of the Sapphire Rapids launch limelight earlier this year was the Xeon W-3400 line, offering core counts up to 56, to offer that much-needed response to the Threadripper Pro onslaught. But limelight doesn’t necessarily correlate with market impact, as more often it’s the lesser-touted but mainstream-priced products that yield the bulk of the eventual revenue stream. Such is the case with Sapphire Rapids.

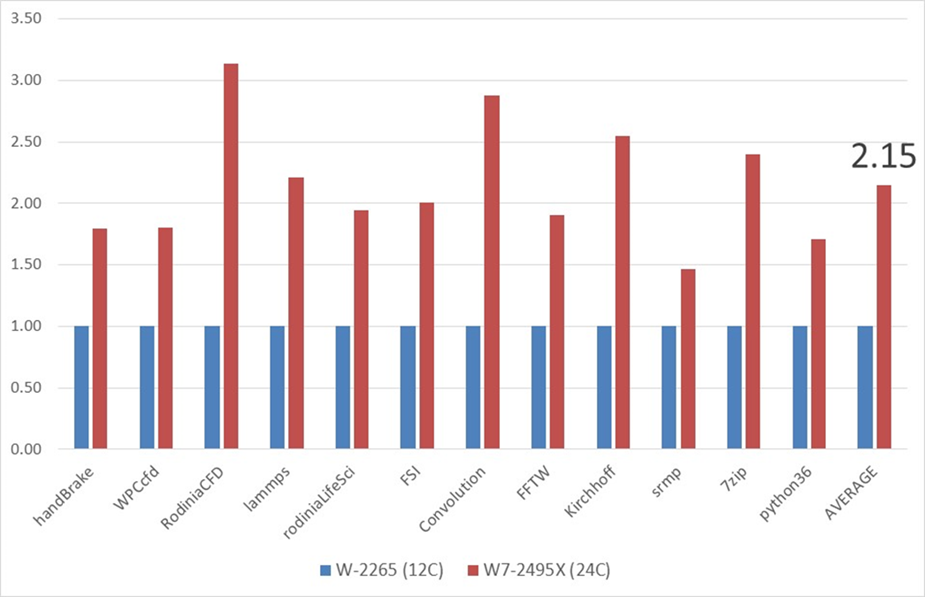

It’s the W-2400 that anchors that lucrative Premium-class midrange, sandwiched between the Core offerings below and the more expensive W-3400 above. More importantly, it’s put an end to the long four-year pause in technology updates for that key segment. How convincing an end? Benchmarking with SPECworkstation indicates a dramatic upgrade in performance a CAD user can expect moving from the previous-generation W-2200 up to the W-2400. Comparing the top-end Xeon W-2495X with the previous flagship W-2265, we find an average 115% improvement in throughput for a wide selection of SPECworkstation tests (version 3.0.4. for historical consistency).

Of course, the W7-2495X offers twice the number of cores as the W-2265, so one might argue this isn’t a fair fight. I’d counter it absolutely is, because the ultimate apple in an apples-to-apples matchup is price. With an introduction at a similar point in that spectrum, it’s the most relevant comparison to buyers, and a doubling of core count at the same price is a logical improvement expected from more than one step in process shrinks.

Intel back on competitive footing across the board, but AMD keeping the pressure on

Intel’s stumble in recent years of execution—more critically on the manufacturing side—left the incumbent in the uncomfortable position of being not the predator but the prey, with an urgent need to restore its competitive edge. With the generations of its Core line (12th Gen Alder Lake and 13th Gen Raptor Lake) in 2022 and 2023, it did so both in Entry-class fixed workstations as well as the breadth of mobiles. After an extended hiatus, with the Sapphire Rapids-generation Xeon W-2400 successor, Intel looks to have fortified its position as the dominant CPU vendor serving the Premium workstation class. (Worth noting, AMD’s HEDT, gamer-focused Threadripper 7000X—without the “Pro” or the “W”—can, depending on the customer, be considered a viable alternative to the W-2400 in that Premium workstation segment. However, its lack of AMD Pro technology support generally makes it a nonstarter in enterprise applications.)

With Xeon W-3400, Intel has at least slowed AMD’s incursion in the Ultimate class, more or less catching up to the Threadripper Pro 5000WX generation from 2022. However, AMD is keeping the pressure on, and its 7000WX line has again established performance leadership in the Ultimate class, albeit one which has yet to translate to volume leadership.

Mobile versus fixed workstations: Different tools optimized for different objectives

The workstation-focused benchmark results validate the proposition that a mobile workstation like the Precision 5680 offers the highest-performing, most reliable computer for professional users away from their desk. But the same results refute a common misconception floating around the workstation market, one that OEMs have been complicit in propagating and one that gained momentum in the midst of the pandemic: that mobile workstations can replace fixed workstations. That’s a notion that may hold for a minority—those whose demands are more modest and can be fully met with a mobile—but one that certainly doesn’t as a rule. It absolutely does not apply to that longtime core user base of the traditional workstation market: those whose demands are never truly satisfied, but rather those who take what they can get for now, while looking forward to welcomed future incremental performance when available.

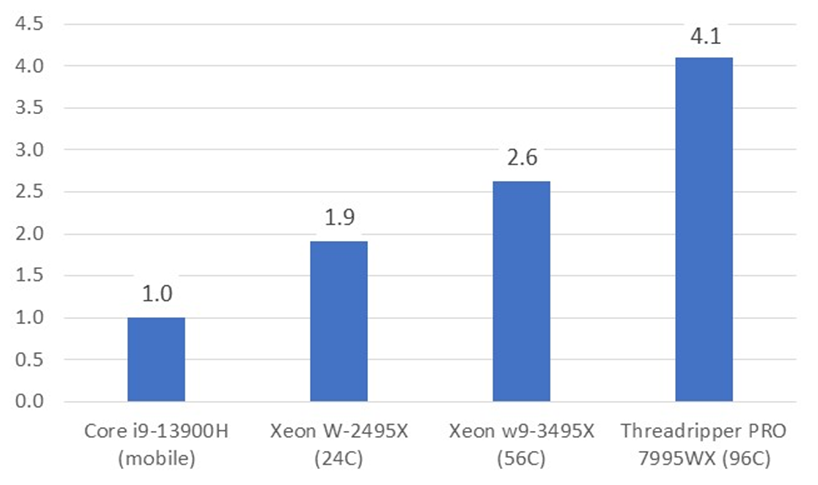

Consider the chart above, reflecting the relative SPECworkstation performance of the workstation-relevant CPUs surveyed here. The Core i9-13900H-equipped Dell Precision 5680 delivers performance levels never before available in such a thin, light package. Then walk up a sampling of the current models available in the fixed Premium and Ultimate class, and it’s clear there’s plenty more available performance for those who need it and tend to spend the majority of their time at the desk.

Simply put, mobile and fixed workstations are apples and oranges, optimized for different priorities: mobility at the expense of performance for the former, and performance at the expense of mobility for the latter. For top performance, there’s no substitute for a fixed workstation, and furthermore, there never will be. That dichotomy explains why, for the core workstation base that continues to value incremental performance, it’s not a choice of one or the other, but both. The fixed workstation remains the workhorse sitting deskside, complemented by the user’s mobile workstation away from the office, clearly reflected in market volume split that today sits very close to 50/50.

An in-depth look at the workstation market can be found in the JPR Workstation Professional Computing Markets and Technologies report series.