Jon Peddie Research reports the growth of the global PC-based Graphics Processor Units (GPU) market reached 101 million units in Q4'21 and PC CPUs shipments decreased by -21% year over year. Overall GPUs will have a compound annual growth rate of 4.5% during 2020–2025 and reach an installed base of 3,331 million units at the end of the forecast period. Over the next five years, the penetration of discrete GPUs (dGPU) in the PC will grow to reach a level of 42%.

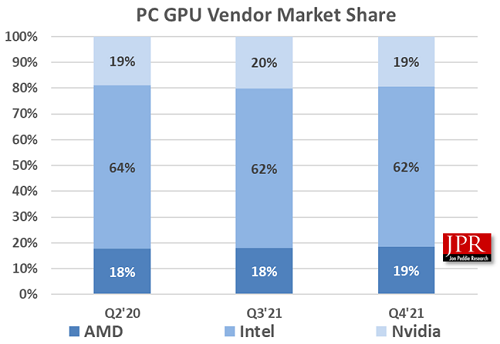

AMD's overall market share percentage from last quarter increased 0.7%, Intel's market share decreased by -0.1%, and Nvidia's market share decreased by -0.60%, as indicated in the following chart.

|

| Quarterly shipments and market share percentages and year-to-year results |

Overall GPU unit shipments increased by 0.8% from last quarter: AMD shipments increased 4.7%, Intel's shipments rose 0.6%, and Nvidia's shipments decreased by -2.2%.

Quick highlights

- The GPU's overall attach rate (which includes integrated and discrete GPUs, desktop, notebook, and workstations) to PCs for the quarter was 121%, down -3.8% from last quarter.

- The overall PC CPU market increased by 3.9% quarter-to-quarter and decreased -by 21% year-to-year.

- Desktop graphics add-in boards (AIBs that use discrete GPUs) increased by 3.0% from the last quarter.

- This quarter saw a 22.0% change in tablet shipments from last quarter.

The fourth quarter is typically flat to up, compared to the previous quarter. This quarter was up 0.8% from last quarter, which is below the 10-year average of 1.6%.

GPUs are traditionally a leading indicator of the market because a GPU goes into a system before the suppliers ship the PC. AMD and Nvidia are guiding up for the next quarter, and Intel is down for an average of -0.38%. Last quarter, they guided down -1.53%, which was too low.

The total (desktop and notebook) market share for the two dGPU suppliers is shown in the following table.

| Q4'20 | Q3'21 | Q4'21 | |

| AMD | 18% | 17% | 19% |

| Nvidia | 82% | 83% | 81% |

| PC dGPU shipment market shares | |||

In a year like no other, suppliers reported shortages of component parts, capacitors, substrates, and other items. Even companies with a diverse portfolio were forced to allocate to the various segments they served. No one was happy about it, and, unfortunately, the upcoming inventory build-out for the holiday season that usually takes place in the third quarter will be constrained until the supply chain catches up with demand.

Jon Peddie, President of JPR, noted, “The disruptions in the supply chain caused by COVID and aggravated by Intel’s manufacturing difficulties have made forecasting unusually challenging. In this reporting period of late February, the world is facing turmoil in Ukraine, and continuing mutations of the virus, compounded by a disturbed workforce and new norms of work location. The forecast for the rest of the year is confusion and surprise.”

JPR also publishes a series of reports on the graphics Add-in-Board Market and PC Gaming Hardware Market, which covers the total market, including system and accessories, and looks at 31 countries.

Pricing and availability

JPR’s Market Watch is available and sells for $2,750. This report includes an Excel workbook with the data used to create the charts, the charts themselves, and supplemental information. The annual subscription price for JPR’s Market Watch is $5,500 and includes four quarterly issues. Full subscribers to JPR services receive TechWatch (the company’s bi-weekly report) and a copy of Market Watch as part of their subscription.

Click here to learn more about this significant report or to download it now. For more information, call 415/435-9368 or visit the Jon Peddie Research website at www.jonpeddie.com.

Contact Robert Dow at JPR ([email protected]) for a free sample of TechWatch.

About Jon Peddie Research

Dr. Jon Peddie has been active in the graphics and multimedia fields for more than 30 years. Jon Peddie Research is a technically oriented multimedia and graphics research and consulting firm. Based in Tiburon, California, JPR provides consulting, research, and other specialized services to technology companies in various fields, including graphics development, multimedia for professional applications and consumer electronics, high-end computing, and Internet-access product development. JPR’s Market Watch is a quarterly report focused on PC graphics controllers’ market activity for notebook and desktop computing.

Company Contact:

Jon Peddie, Jon Peddie Research

415/435-9368

[email protected]

Robert Dow, Jon Peddie Research

415/435-9368

[email protected]

Media Contact

Carol Warren, Crew Communications

714.890.4500

[email protected]