Nvidia has the mindshare, but AMD has the competitive products to hold its own against Intel and Nvidia. They just need to get the message out.

The Silicon Valley is replete with comeback stories of companies left for dead, the most famous of all being Apple. Right behind Apple on the comeback trail would have to be AMD, a company that was teetering on the verge of bankruptcy and complete irrelevance 10 years ago.

The company went through a string of CEOs, but none of them could stop the bleeding. Its desktop chips regularly lagged behind Intel’s best. Its Opteron servers were almost a complete nonentity. Mercury Research, which tracks the CPU sales market, put the Opteron installed base at less than 1% in 2016. The company’s Radeon GPU business fared a little better but was being utterly steamrolled by the juggernaut that is Nvidia.

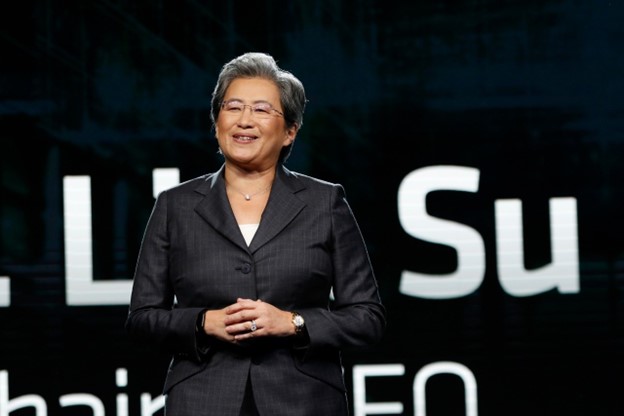

Then came the turnaround, starting in 2014 with the hiring of ex-IBM executive Dr. Lisa Su as CEO, followed by the 2017 release of the company’s first generation of CPUs based on a whole new architecture called Zen. AMD ditched its mediocre designs and started from scratch. Very quickly, people realized that Zen was the real deal, finally a viable alternative to Intel, which had stumbled in its efforts.

In addition to its homegrown products, AMD made two strategic acquisitions: FPGA developer Xilinx and networking chipmaker Pensando. Overnight, AMD became a significant player in networking, a business it had never been in before.

Su is the subject of a lengthy, glowing profile on Forbes.com, which raises the obvious point that AMD is now ready for a piece of the AI pie that Nvidia has been gorging itself on for the last few years. No longer in a defensive crouch and fighting off potential bankruptcy, AMD is ready to make some moves.

| AMD Revenue & Income ($B) | |||||||

| FY 2016 | FY 2017 | FY 2018 | FY 2019 | FY 2020 | FY 2021 | FY 2022 | |

| Revenue | $4.27 | $5.25 | $6.47 | $6.73 | $9.76 | $16.43 | $23.69 |

| Net Income | ($0.49) | ($0.03) | $0.34 | $0.34 | $2.49 | $3.16 | $1.32 |

| R&D | $1.00 | $1.19 | $1.43 | $1.54 | $1.98 | $2.85 | $5.00 |

| Cash on hand | $1.26 | $1.07 | $1.18 | $1.46 | $1.60 | $2.53 | $4.83 |

As the above chart shows, AMD has only recently had the cash flow to fund the kind of R&D efforts needed to make headway in AI. The Zen architecture earned kudos right out of the gate when it launched in 2017, but the market was leery after so many years of poor performance. So it has taken the company a while to build up the financial momentum needed to compete with Nvidia.

So now AMD, even with the competitive Instinct product line, has to make up for a 20-year head start on the part of Nvidia. AMD won’t erase that overnight, but it is nibbling away at that lead.

AMD earned significant bragging rights with the launch in 2022 of Frontier, the first supercomputer to break the exaFLOP barrier. The computer, based at the Department of Energy’s Oak Ridge National Labs, is an all-AMD affair; it is all Epyc CPUs and Instinct GPUs—no Intel or Nvidia anywhere.

Twice per year, the Top500 Project publishes a list of the 500 fastest known supercomputers in the world. For the longest time, it was all Intel and Nvidia. The most recently released list has 121 AMD-powered systems, a 29% YoY growth. Of the 44 new systems added to the list this year, AMD powers 21 of them.

And Microsoft has reportedly teamed up with AMD to help boost AMD’s efforts and for AMD to help Microsoft with that company’s custom initiatives. Bloomberg says Microsoft is providing engineering resources to support AMD’s efforts specifically to bolster AMD’s push against Nvidia. In turn, AMD is reportedly helping Microsoft to develop its own in-house AI chips, code-named Athena. Bloomberg claims that Microsoft has already sunk around $2 billion into Athena development, but a Microsoft executive has denied that AMD is involved with Athena.

That Microsoft is supporting AMD to prop up its AI efforts is hardly a surprise. No one wants to be beholden to a monopoly, and Microsoft knows that all too well since it is one. So it makes sense that Microsoft would want to lift up AMD.

Several years ago, there was a concerted effort to bring Arm-based server processors to market. Companies ranging from giant Qualcomm to start-ups like Ampere had multiple products in the pipeline. Most have fallen on the wayside except for Ampere.

The reason there was so much interest in Arm last decade is because AMD had ceased to be an effective competitor to Intel in the server space. As noted earlier, its Opteron server chips had less than 1% market share, and no one wanted Intel to have complete hegemony over the server market, even though it did. With AMD’s revival, interest in Arm-based server products has waned. Enterprises got the alternative to Intel that they long wished for.