What do we think?

A good start to a new era for Arm. Higher royalty rates were a key promise to shareholders at the IPO, and Arm is delivering.

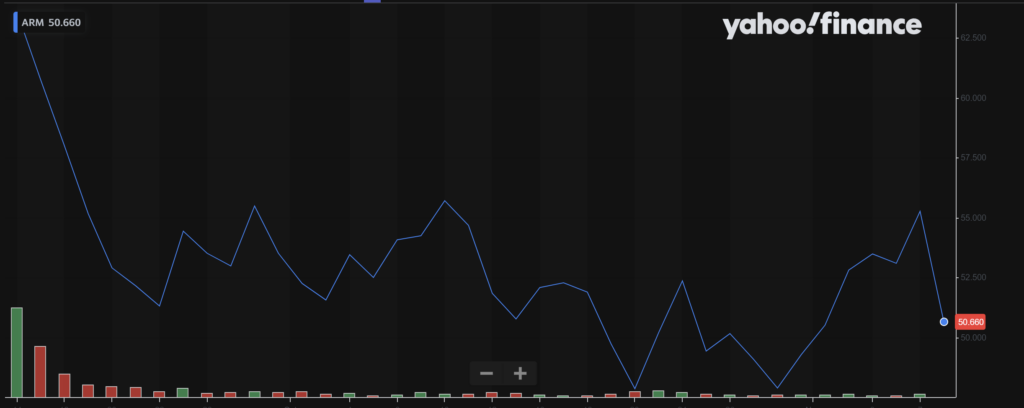

Arm reassures new shareholders

Arm’s revenue surged by 28% compared to the previous year, surpassing $800 million for the first time. This growth showcases the success of Arm’s diversified business strategy.

The notable revenue increase was mainly driven by signing several long-term license agreements with top technology companies, along with higher royalty rates and market share gains that boosted royalty revenue.

License revenue was also up by an impressive 106% year over year, with the use of Arm in AI platforms partly responsible alongside a continued need for power-efficient solutions in infrastructure and automotive (Arm cites double-digit royalty growth in those markets). Arm’s influence in the AI realm expanded as companies like Google, Meta, Nvidia, Renesas, and Xiaomi announced new energy-efficient AI-capable products.

Arm’s non-GAAP operating profit saw a substantial increase of 92% year over year, reaching $381 million, leading to a non-GAAP operating margin of 47.3%.

Furthermore, the cumulative total of shipped Arm-based chips reached 272.5 billion, with 7.1 billion chips reported as shipped.

An in-depth report on the Arm IPO background and possibilities, as well as the predictions, potentials, and pitfalls, can be found here.