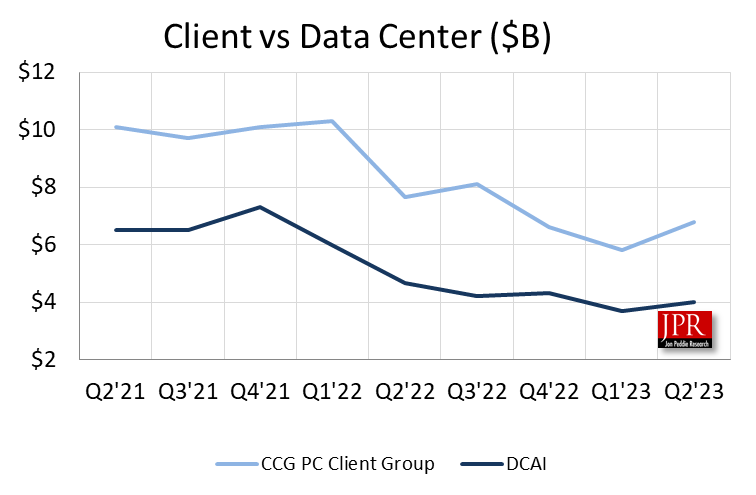

Intel’s client and server processor sales are still down year over year, but the numbers are better than the previous quarter.

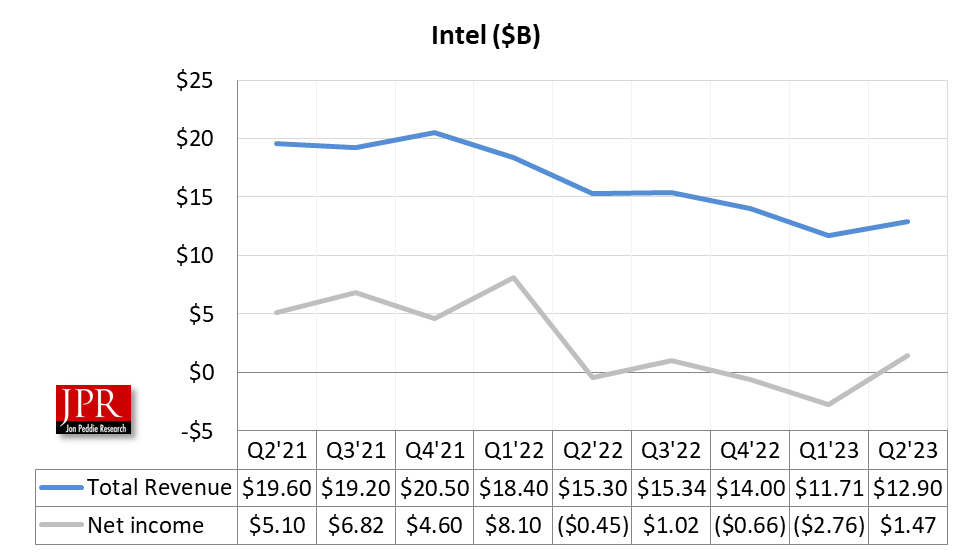

Intel had a better-than-expected second quarter for 2023, posting revenue and net income that exceeded Wall Street analyst projections. However, on a closer look, things are not quite as rosy as they were made out to be.

On a GAAP basis, the company earned an adjusted $1.5 billion, or 35 cents a share on sales of $12.9 billion in the second calendar quarter ending June 30, 2023.On a non-GAAP basis, net income was $500 million, or 13 cents per share. Analysts polled by financial data company FactSet had expected Intel to lose 4 cents a share on sales of $12.12 billion.

In the same quarter last year, Intel lost $454 million, or 11 cents per share on sales of $15.32 billion. There were two factors at play here. First, Intel has been tightening its belt and got a handle on expenses. Operating expenses for Q2’23 were $5.65 billion, down 10% from Q2’22 OpEx of $6.28 billion.

Second, Intel reported an operating loss of $1.01 billion. It’s only because it got a sizable onetime tax credit of $2.29 billion that bolstered net profit. So even with the 10% reduction year over year in operating expenses and the growth in sales, Intel is still operating at a loss.

Lower gross margin from revenue was due to weakness in all categories.

“Our Q2 results exceeded the high end of our guidance as we continue to execute on our strategic priorities, including building momentum with our foundry business and delivering on our product and process road maps,” said Intel CEO Pat Gelsinger in a statement. “We are also well-positioned to capitalize on the significant growth across the AI continuum by championing an open ecosystem and silicon solutions that optimize performance, cost, and security to democratize AI from cloud to enterprise, edge, and client.”

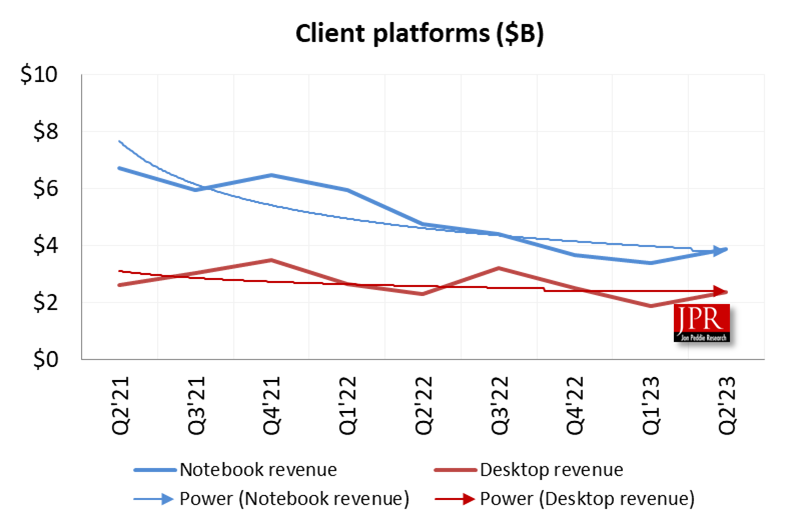

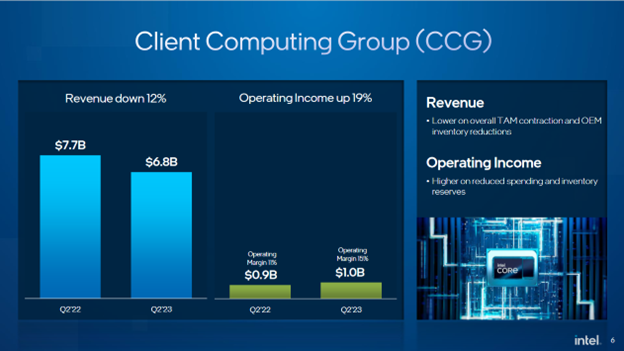

Revenue from the Client Computing Group (CCG) business for the quarter was $6.8 billion, up 12% from the $5.8 billion in Q1 but still down from $7.67 billion in Q2’22. The company attributed this growth to recovery in the consumer, performance, and education markets.

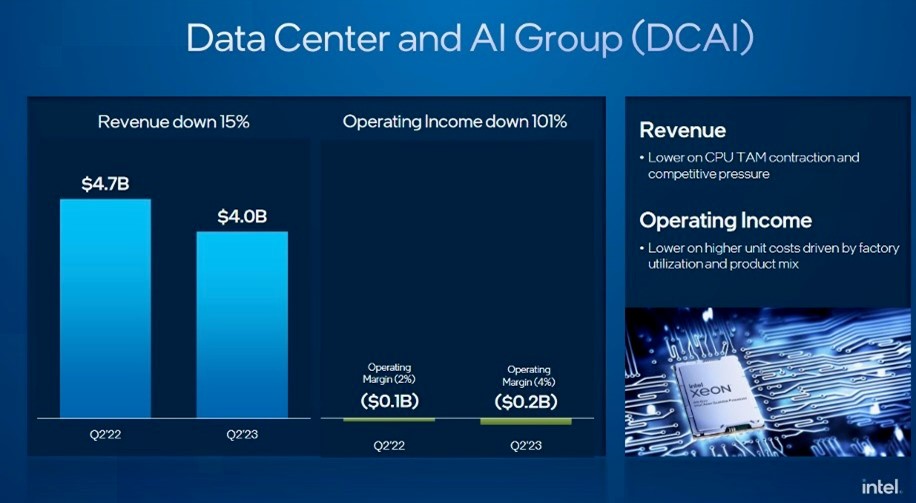

The Data Center and AI (DCAI) business unit saw sales of $4.0 billion, up 8% from the $3.7 billion in Q1 but still below the $4.65 billion from a year earlier. Gelsinger said the new fourth-generation Xeon Scalable processor is showing “strong customer demand despite the mixed overall market environment,” adding that Intel is about to ship its millionth Gen 4 Xeon and estimates more than 25% of Xeon data center shipments are targeted for AI workloads.

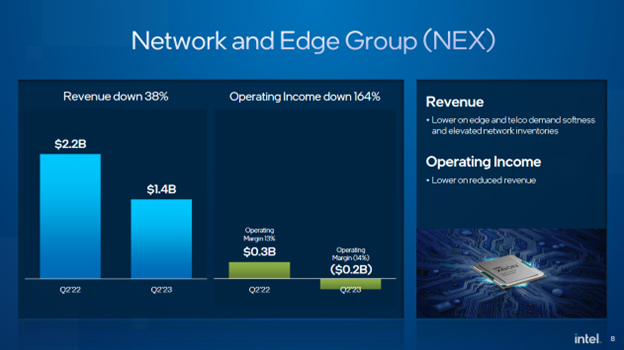

A new category, Networking and Edge, reported revenue of $1.36 billion, down 11% from the $1.4 billion in the previous quarter and significantly lower than the $2.21 billion in the same period last year.

During a conference call with financial analysts, Gelsinger and CFO David Zinsner said the company continues to burn off inventory as intended. The total was reduced by $1 billion, or 18 days in the quarter, and accounts receivable declined by $850 million, or seven days, as the company continues to focus on disciplined cash management.

Google Cloud has made the cloud instances of DCAI’s 4th Gen Intel Xeon Scalable processors available to the public. Third-party validation from MLCommons confirmed the AI-acceleration capabilities of Intel, with MLPerf Training performance benchmark data showcasing the competitiveness of 4th Gen Xeon and Habana Gaudi2 in the AI market, excelling in both performance and price. Furthermore, Intel collaborated with Boston Consulting Group to provide secure, enterprise-grade generative AI solutions to customers, leveraging Intel’s Gaudi and 4th Gen Xeon offerings.

Gelsinger said the data center road map remains on or incrementally ahead of schedule with Emerald Rapids, the 5th Gen Xeon Scalable, set to launch in Q4 of this year. Granite Rapids will follow shortly in 2024.

Intel sees the server CPU inventory digestion persisting in the second half, and in the near-term, more customer emphasis on AI accelerators rather than general-purpose compute in the cloud.

“We expect Q3 server CPUs to modestly decline sequentially before recovering in Q4. Longer term, we see AI as TAM expansive to server CPUs, and more importantly, we see our accelerator product portfolio as well positioned to gain share in 2024,” said Gelsinger.

Intel’s CCG experienced robust demand for its 13th Gen Intel Core processor family, with over 300 designs anticipated from OEM partners in the current year. The company also unveiled a partnership with Microsoft aimed at advancing AI development for personal computing. At Microsoft’s Build 2023 conference, Intel provided a sneak peek at the AI-enabled features of its upcoming Meteor Lake client PC processors. Furthermore, Intel introduced the Intel Arc Pro A60 and Pro A60M as new additions to the Intel Arc Pro A-series professional GPU lineup.

For NEX, Intel, Ericsson, and HPE successfully demonstrated the industry’s first vRAN solution running on the 4th Gen Intel Xeon Scalable processor with Intel vRAN Boost. Intel also recently completed an agreement with Ericsson to partner broadly on its next-generation optimized 5G infrastructure, under which Ericsson will utilize Intel’s 18A process technology for its future custom 5G SoC.

In addition, Intel and Ericsson will expand the collaboration announced at Mobile World Congress 2023 to accelerate industry-scale open RAN utilizing standard Intel Xeon-based platforms as telcos transform to a foundation of programmable, software-defined infrastructure.

Mobileye continued to generate strong profitability in the second quarter and demonstrated traction with its advanced product portfolio by announcing a SuperVision eyes-on, hands-off design win with Porsche and a mobility-as-a-service collaboration with Volkswagen Group that will soon begin testing.

Outlook

Intel’s guidance for the second quarter of 2023 includes both GAAP and non-GAAP estimates.

Q3 2023 GAAP and non-GAAP revenues are both projected to be between $12.9 billion and $13.9 billion. GAAP gross margin is projected to be 39.1%, while non-GAAP margin is around 43%. Projected GAAP earnings per share is expected to be $0.04, while non-GAAP EPS is put at $0.204.

Intel’s guidance for the second quarter of 2023 includes both GAAP and non-GAAP estimates.

Q3 2023 GAAP and non-GAAP revenues are both projected to be between $12.9 billion and $13.9 billion. GAAP gross margin is projected to be 39.1%, while non-GAAP margin is around 43%. Projected GAAP earnings per share is expected to be $0.04, while non-GAAP EPS is put at $0.204.