At CES, key players showcased their GenAI advancements for cars. Intel acquired Silicon Mobility for AI-enhanced vehicle SoCs. Qualcomm highlighted its Snapdragon Digital Chassis for customized AI experiences. AMD introduced adaptive SoCs and processors for automotive applications. Sony Honda Mobility showcased the Afeela car with customizable screens and a conversational personal agent. The industry is focusing on in-vehicle infotainment, energy management, and personalized experiences. We are covering Nvidia and Imagination in separate stories.

What do we think? GenAI is suddenly a thing for cars. Want your Mercedes to know everything about Mercedes? Nvidia has you covered. Want to plaster your own art, or GenAI art, over the bumper of your car? That’s Sony Honda Mobility, working with Qualcomm. Want your car to have “living room experiences”? No, we aren’t sure about that either, but Intel is pushing it, and apparently, it’s mostly just voice assistants (what these ones know about Mercedes was not confirmed).

There’s a significant variance in philosophy among the key players. Qualcomm is all about power-efficient, open, and scalable solutions, which let them get right down to the two-wheeler and micromobility segments. Nvidia boasts that their auto solutions started in the data center and have been scaled down for automotive. Intel is focused on a holistic approach that now will include charging tech and pushes them in a more embedded direction. Imagination continues to push ASIL compliance. AMD has automotive-grade offerings now too and positions a PC-like experience.

We agree that advances across consumer electronics (especially smartphones) have raised expectations for in-vehicle infotainment (IVI), but it remains a market in which power, robustness and efficiency are crucial factors for the Tier 1s, creating a split among the power-hungry, post-PC Nvidia and AMD, the slightly more embedded Intel, and the traditional, deeply embedded, and mobile-like Qualcomm and Imagination (via its customers–TI, Renesas, etc.).

There is unquestionably space for them all right now: All have Tier 1 customers, though AMD only cites Tesla publicly. Going forward, we think the market will copy the car models, with premium (and perhaps less practical) experiences at the expensive, top end of the market, and plenty of solid, acceptable utility at the lower end of the market. Volume will predictably be in the middle and lower end of the market, but the big question is about value and whether Nvidia can secure margins comparable to their other segments. Based on conversations with OEMs at CES, we think it will be a challenge.

GenAI features start to debut for cars at CES

Intel

First up, Intel, which announced the acquisition of Silicon Mobility SAS to “bring AI efficiencies to electric vehicle (EV) energy management.” This will be subject to necessary approvals, but we don’t foresee any problems for Intel in this deal.

Intel AI-enhanced software-defined vehicle (SDV) SoCs will enable in-vehicle AI such as GenAI and camera-based driver/passenger monitoring.

Silicon Mobility SAS is a fabless automotive silicon and software company that does EV energy management SoCs with accelerators purpose-built for energy delivery and codesigned with software algorithms to deliver gains in vehicle energy efficiency.

In other Intel news, Zeekr will use Intel’s new SDV SoC to bring enhanced GenAI living room experiences to next-generation vehicles. If you are in the Intel ecosystem, or want to be, you will also be pleased to hear that Intel is to deliver an automotive chiplet platform, enabling customers to integrate their own chiplet into an Intel Automotive product.

“Intel is taking a whole-vehicle approach to solving the industry’s biggest challenges. Driving innovative AI solutions across the vehicle platform will help the industry navigate the transformation to EVs,” said Jack Weast, vice president and general manager of Intel Automotive. “The acquisition of Silicon Mobility aligns with our sustainability goals while addressing a critical energy management need for the industry.”

Today, Intel SoCs are in more than 50 million vehicles, powering infotainment, displays, digital instrument clusters, and more. Tomorrow, Intel’s expanded AI-enhanced whole-vehicle road map will move the industry toward a more scalable, software-defined, and sustainable future.

Qualcomm

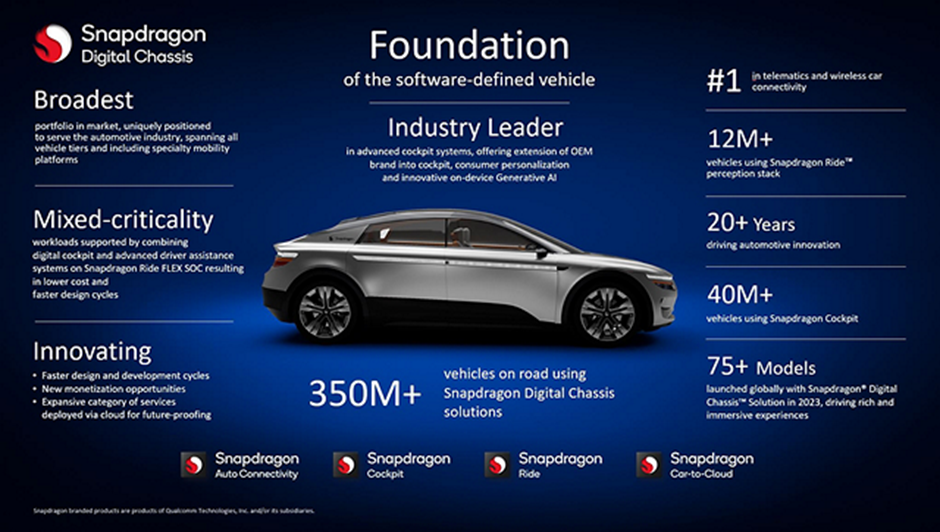

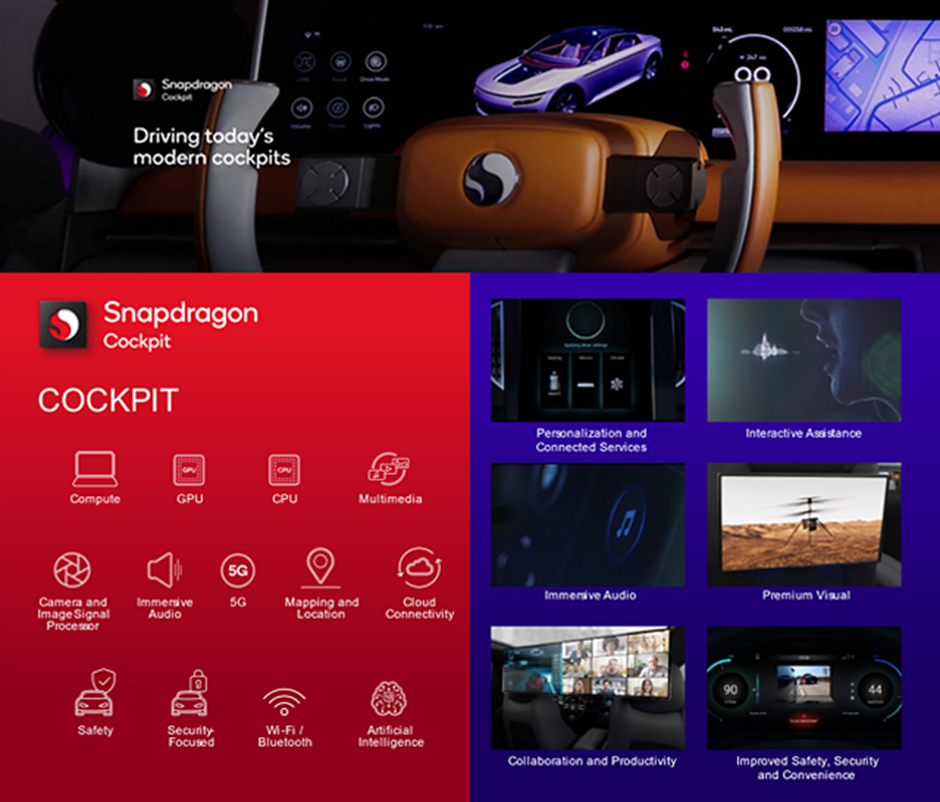

Qualcomm is very proud of the success of the Snapdragon Digital Chassis, and a BMW promoting it greeted conferencegoers as they arrived at the West Hall during CES. The Snapdragon Cockpit Platform offers enhanced graphics, multimedia capabilities, and artificial intelligence (AI) functionalities that can be customized for each occupant and scaled across different vehicle tiers.

There are more than 350 million vehicles on the road with Snapdragon Digital Chassis solutions to date, Qualcomm says. They are looking to maintain this momentum with a full suite of products for next-generation GenAI-enabled digital cockpits, connected car technologies, connected services, advanced driver assistance, and automated driving systems.

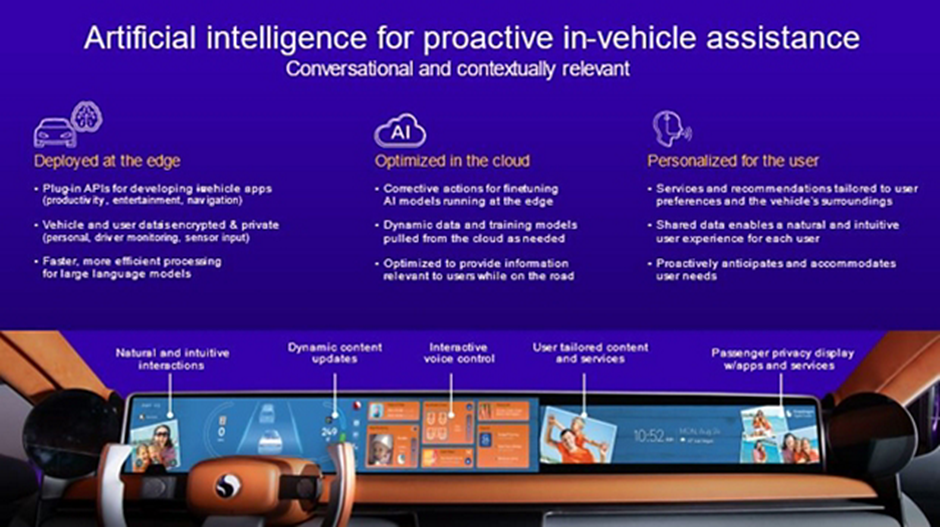

Qualcomm says edge-based generative AI will play a critical role in transforming the cabin, with the goal of delivering powerful, efficient, private, safer, and more personalized experiences to drivers and passengers, running on the edge. That means Snapdragon Digital Cockpit Platforms are already getting GenAI capabilities.

AMD

AMD focused on its new Versal AI Edge XA adaptive SoCs and Ryzen Embedded V2000A series processors. They had an impressive range of tech partners including BlackBerry, Cognata, Ecarx, Hesai, Luxoft, QNX, QT, Robosense, Seyond, Tanway, Visteon, and Xylon, but they remain relatively light on cars, continuing to cite Tesla as their flagship partner.

Versal AI Edge XA adaptive SoCs add an AI engine, enabling the devices to be optimized for numerous next-generation advanced automotive systems and applications including forward cameras, in-cabin monitoring, lidar, 4D radar, surround view, automated parking, and autonomous driving. Versal AI Edge XA adaptive SoCs are also the first AMD 7nm device to be automotive-qualified, bringing hardened IP and added security to automotive applications where safety is paramount. We are assuming this means that AMD is confident of end devices being at least ASIL B-certifiable.

Ryzen Embedded V2000A series processors target the automotive digital cockpit, including the infotainment console, digital cluster, and passenger displays. AMD describes this as a PC-like experience, positioning themselves toward the higher end of the market, though they are less aggressive on this than Nvidia.

Entertainment, connectivity, workplace on wheels, and safety are becoming important factors that influence consumer decisions, which is what led AMD to launch the new AMD Ryzen Embedded V2000A series processor. This auto-grade device enables carmakers to deliver impressive performance and multitasking for infotainment and IVX systems so passengers can stay connected on the go.

Built on 7nm process technology, Zen 2 cores, and AMD Radeon Vega 7 graphics, the AMD Ryzen Embedded V2000A series processor delivers both decent graphics and enhanced security features and automotive software enablement (through hypervisors), in addition to support for Automotive Grade Linux and Android Automotive.

SHM (Sony Honda Mobility)

SHM brought impressive rhetoric and drama to CES 2024, introducing the Afeela car at their press conference that was controlled with a PS5 gamepad. They are pushing the car as being a personal agent for mobility with GenAI features that largely focus on customizable screens in the cockpit, the rear passenger area, and front bumper. Harkening back to the PlayStation Emotion Engine, they described the goal as an emotional experience in the car.

The two are also working with Microsoft on the concept. Microsoft will provide a conversational personal agent based on Azure AI technology. Less promoted but key to the product is Qualcomm, on whose Digital Chassis Afeela is based. Qualcomm is a major silicon partner for Sony in many areas for 2024 including gaming, XR, and automotive.