Despite a little softness in the consumer graphics market, data center sales more than made up for it, and Nvidia beat expectations for its fiscal first-quarter 2024 earnings. It also gave exceptional guidance for the third fiscal quarter, projecting a 50% rise in revenue.

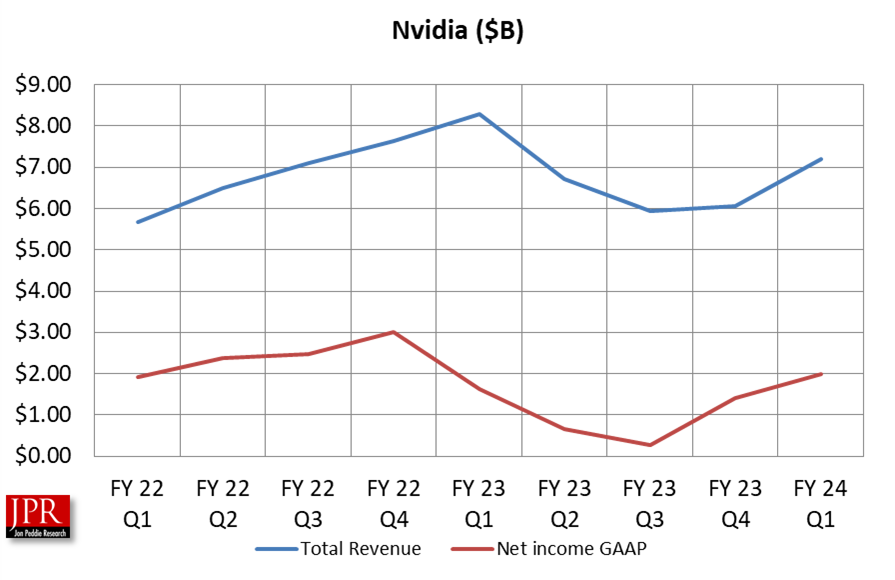

Nvidia reported fiscal first-quarter 2024 earnings of $2.04 billion, or 82 cents a share, on sales of $7.19 billion, down from $8.29 billion in the same quarter last year but well ahead of expectations. Analysts were expecting adjusted average earnings of 92 cents a share on sales of $6.53 billion, according to FactSet, a financial data company.

GAAP operating expenses were down 30% from a year ago and down 3% sequentially. The prior year included a termination charge of $1.35 billion for the proposed Arm acquisition, and the prior quarter included fixed asset write-downs.

Non-GAAP operating expenses were up 9% from a year ago and down 1% sequentially. The year-on-year increase was driven by employee growth and related costs. The sequential decrease reflects timing of engineering development investments and reduced depreciation expense related to the extension of certain fixed asset useful lives, partially offset by employee growth and related costs.

Nvidia’s sales and income have suffered in recent quarters as the company deals with a considerable oversupply in the market, just as Intel and AMD have. This was caused by pandemic-era shortages brought on by initially high demand followed by a sudden stop in demand, leaving suppliers like Nvidia holding a lot of inventory.

But those days are over, says CFO Colette Kress. “With strength in key verticals such as public sector, health care, and automotive, we believe the channel inventory correction is behind us,” she said in a conference call with Wall Street analysts.

During the first quarter of fiscal 2024, Nvidia returned to shareholders $99 million in cash dividends.

Nvidia will pay its next quarterly cash dividend of $0.04 per share on June 30, 2023, to all shareholders of record on June 8, 2023.

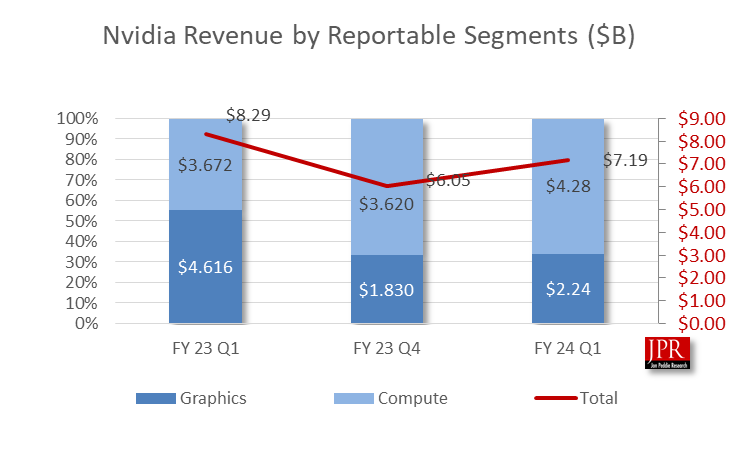

Data center sales now clearly dominate

Just two years ago, the graphics/gaming segment accounted for roughly 60% of Nvidia revenue, while the data center accounted for just under 40% of revenue. With this past quarter, the two have switched: Data center is now 60% of sales (which includes Mellanox), while graphics are just under 40% of sales.

Of course, one must take into account a double whammy, with retail/consumer sales down, and Nvidia introducing a slew of new enterprise product in the past quarter.

“Our entire data center family of products—H100, Grace CPU, Grace Hopper Superchip, NVLink, Quantum 400 InfiniBand, and BlueField-3 DPU—is in production. We are significantly increasing our supply to meet surging demand for them,” said Jensen Huang, founder and CEO of Nvidia, in a statement.

And it doesn’t end there for Huang. He said, “A trillion dollars of installed global data center infrastructure will transition from general purpose to accelerated computing as companies race to apply generative AI into every product, service, and business process.” And of course, he’s going to get a piece of it.

Nvidia revenue by segment

Revenue was $7.19 billion, down 13% from a year ago and up 19% sequentially.

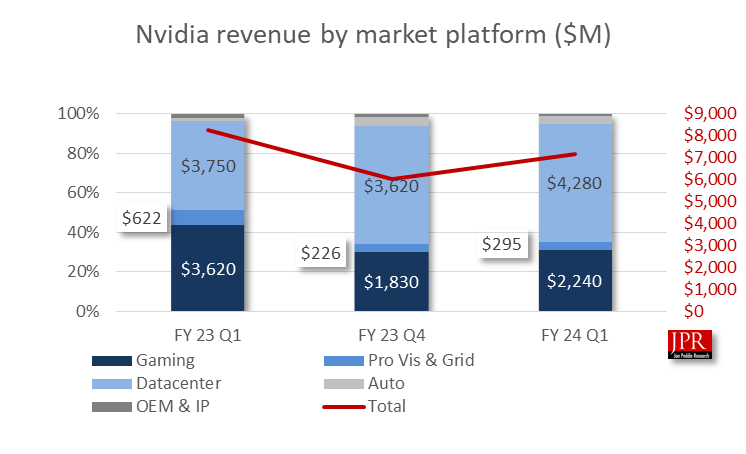

Data Center revenue was a record, up 14% from a year ago and up 18% sequentially, led by growing demand for generative AI and large language models using GPUs based on Nvidia’s Hopper and Ampere architectures. The revenue growth reflects strong demand from large consumer Internet companies and cloud service providers. Enterprise demand for GPU platforms was strong, although general-purpose networking solutions declined both sequentially and from a year ago.

Gaming revenue was down 38% from a year ago and up 22% sequentially. The year-on-year decrease reflects weaker demand due to the macroeconomic slowdown and lower shipments to normalize channel inventory levels. The sequential increase was driven by the ramp of Nvidia’s new GeForce RTX 40 series GPUs, based on the Ada Lovelace architecture, for desktops and laptops.

Professional Visualization revenue was down 53% from a year ago and up 31% sequentially. The year-on-year decrease reflects lower sell-in to partners to help reduce channel inventory levels. The sequential increase was driven by higher demand for desktop and mobile workstation GPUs.

Automotive revenue was up 114% from a year ago and up 1% sequentially. The year-on-year increase reflects growth in sales of self-driving platforms and AI cockpit solutions.

OEM and Other revenue was down 51% from a year ago and down 8% sequentially. These decreases were primarily driven by lower entry-level notebook GPU sales.

Ready to spend

GAAP operating expenses were down 3%, and non-GAAP operating expenses were down 1%. Nvidia has held the line on expenses, spending about $630 million during the last three quarters each. It has managed to avoid layoffs or cuts to bonuses for staff, something its competition can’t say. And seeing light at the end of the tunnel, the company looks to be ready to spend again.

“We have held OpEx at roughly the same level over the last past four quarters while working through the inventory corrections in gaming and professional visualization,” Kress told analysts. “We now expect to increase investments in the business, while also delivering operating leverage.”

Second quarter of fiscal 2024 outlook

Nvidia projects revenue for the second quarter of fiscal 2024 to be $11.00 billion, plus or minus 2%. GAAP and non-GAAP gross margins are expected to be 68.6% and 70.0%, respectively, plus or minus 50 basis points. GAAP and non-GAAP operating expenses are expected to be approximately $2.71 billion and $1.90 billion, respectively.

GAAP and non-GAAP tax rates are expected to be 14.0%, plus or minus 1%, excluding any discrete items. Capital expenditures are expected to be between approximately $300 million and $350 million, including principal payments on property and equipment.